Can You invest in Indonesia? Yes, Here’s How

When you invest in Indonesia, you’re not choosing just another emerging market. You’re tapping 280 million smartphone users, a pro-FDI government lowering barriers for foreign investors, and infrastructure advancing faster than most of Southeast Asia.

In early 2025, Indonesia dropped its minimum paid-up capital requirement to IDR 2.5 billion (about USD 156,000), down from IDR 10 billion. That’s real money you don’t have to lock up on day one, which means better cash flow while you’re building.

The timing matters because the Indonesian economy is pushing hard into data centers, renewable energy, and EV manufacturing. If you’ve been watching from the sidelines, this is your window to invest.

Snapshot, Market, Policy & What Changed in 2025

Indonesia is spending big on infrastructure. The government is halfway through a multi-year push to connect islands, expand ports, and build out the electrical grid. Energy transition projects are everywhere: solar farms in Java, geothermal in Sumatra, and battery production tied to the country’s massive natural resources in nickel. One example: the USD 9 billion Indonesia Battery Corporation joint venture that’s attracting EV players from three continents and creating jobs across multiple provinces.

The investment climate has improved significantly in the past few years. Indonesia is part of the Regional Comprehensive Economic Partnership (RCEP), the world’s largest trade agreement covering 30% of global GDP. This gives businesses in Indonesia preferential access to markets across Southeast Asia, as well as to China, Japan, South Korea, Australia, and New Zealand. Foreign direct investment hit record levels in 2024, with many businesses choosing Indonesia as their production base for the region.

Here’s what investors need to know right now:

The Positive Investment List (PR 10/2021, amended by PR 49/2021) replaced the old Negative Investment List and tells you which business sectors allow 100% foreign ownership and which require a local partner. It’s not guesswork; it’s published government regulation. Most tech, manufacturing, and renewable energy sectors are wide open to foreign direct investment. Retail, certain healthcare segments, and media have restrictions. The Indonesian government reviews and updates this list regularly to encourage investment in priority sectors.

Paid-up capital minimums just changed. You need IDR 2.5 billion in paid-up capital now, down from IDR 10 billion. Your total investment plan still needs to exceed IDR 10 billion per business classification (KBLI) and location, but you’re not depositing all of it upfront. The capital you do deposit stays in your company account and can be used for business activities, rent, salaries, and equipment. The government tracks it through your quarterly investment reports.

OSS-RBA is your single window. OSS stands for Online Single Submission, and RBA means Risk-Based Approach. You file everything digitally through one portal. Your NIB (business identification number) comes from this system, and you’ll report your investment progress through LKPM filings every quarter. This streamlined business licensing system was part of the omnibus law reforms that simplified regulations for foreign businesses.

Choose Your Entry Vehicle (With Decision Tree)

You have three main options, and picking the wrong one costs you time and money to unwind.

PT PMA (Foreign-Owned Company)

This is a full Indonesian company where foreigners own 51% to 100% of the shares, depending on the sector. You incorporate it, you control it, you run operations from it. You need a board of directors (minimum one person), a board of commissioners (minimum one person), and those can’t be the same individual. You’ll open a corporate bank account in Indonesia, run payroll through Indonesian entities, and file Indonesian taxes. PT PMA makes sense when you’re here to do business, sell products, sign contracts, hire staff, and operate facilities.

Representative Office (RO)

A representative office can do market research, find suppliers, coordinate with your headquarters, and supervise projects. It cannot sign commercial contracts, issue invoices, or generate revenue in Indonesia. Staff are typically expats on assignment. You’ll still deal with Indonesian tax authorities because RO expenses may create a permanent establishment, but you’re not running a profit center. Use an RO when you’re exploring the market or managing existing relationships, but not selling yet. When you’re ready to transact, you convert to a PT PMA.

Joint Venture

Some business sectors on the Positive Investment List cap foreign ownership at 67%, 49%, or some other percentage. That means you need an Indonesian partner. Joint ventures add complexity, shareholder agreements, profit splits, control provisions, and exit mechanisms. Make sure your partner brings real value (market access, licenses, relationships) and not just a passport. Nominee arrangements where an Indonesian “partner” is really a paid proxy are illegal and will blow up your business if discovered.

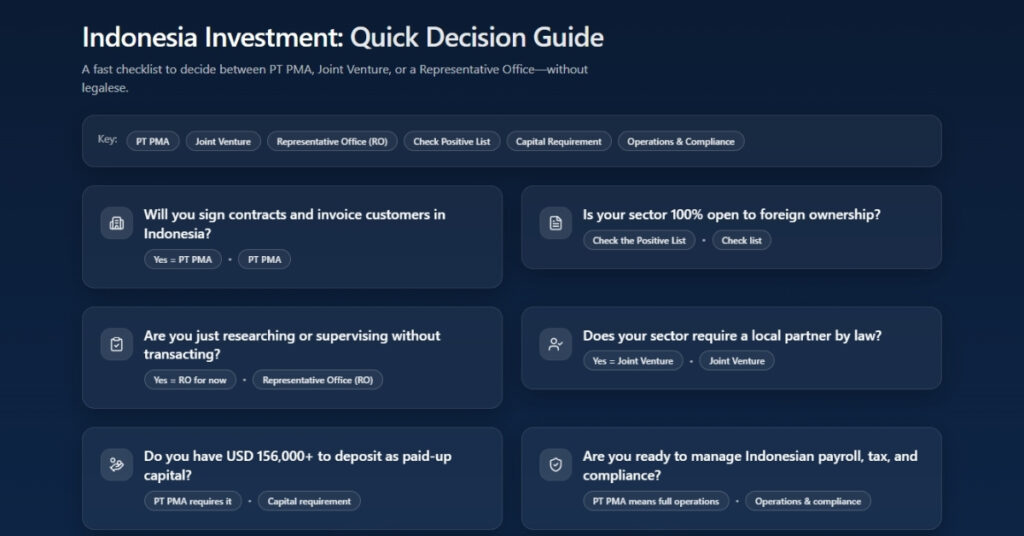

Quick Decision Guide

Answer these six questions:

- Will you sign contracts and invoice customers in Indonesia? (Yes = PT PMA)

- Is your sector 100% open to foreign ownership? (Check the Positive List)

- Are you just researching or supervising without transacting? (Yes = RO for now)

- Does your sector require a local partner by law? (Yes = Joint Venture)

- Do you have USD 156,000+ to deposit as paid-up capital? (PT PMA requires it)

- Are you ready to manage Indonesian payroll, tax, and compliance? (PT PMA means full operations)

Sector Playbooks (Licenses, KBLI, Incentives, Timeline, Risks)

Every sector has its own rules, timelines, and traps. Here’s how to think through the ones getting the most foreign investment attention right now.

Digital Economy & Data Centers

Business codes (KBLI): 63121 (data processing and hosting), 62010 (software development), 63111 (data centers)

Ownership: 100% foreign ownership allowed for most digital economy services. Data centers specifically can be 100% foreign-owned, making Indonesia attractive for companies expanding their digital infrastructure across Southeast Asia.

Licenses and compliance: You need your NIB from OSS-RBA, then risk-based business licensing depending on your data center size and location. The big one everyone asks about is PDPL, Indonesia’s Personal Data Protection Law, which went into effect in October 2024.

You need a Data Protection Officer if you process Indonesian citizens’ personal data at scale. You need consent logs, breach response procedures, and cross-border data transfer documentation if you’re moving data outside Indonesia. The Financial Services Authority (OJK) has additional requirements if you’re handling financial data. Enforcement is ramping up in 2025, and the penalties are real, up to 2% of annual revenue.

Capital patterns: Data centers are capital-heavy upfront, land or long-term lease, cooling systems, power redundancy, fiber connections. Expect USD 5–50 million depending on scale. Operating costs run high for electricity (Indonesia’s rates aren’t the cheapest in ASEAN), but the government offers investment incentives for large-scale facilities.

Talent and visas: Indonesia has solid IT talent in Jakarta, Bandung, and Surabaya. The growing middle class is producing more university graduates with tech skills, supported by human capital development programs. You’ll hire locally for most roles. Work permits (KITAS) for expat managers take 2–3 weeks once your PT PMA is active.

Local partners: Not required by law, but telecom and connectivity providers matter. Relationships with PLN (state electricity company) help for power supply agreements. The payment system infrastructure connects well with Indonesian banks for e-commerce applications.

Red flags: Don’t underestimate PDPL compliance. Don’t skip the DPO requirement. Don’t assume your home-country privacy practices satisfy Indonesian law, they probably don’t.

Renewable Energy & Power

Business codes: 35101 (electric power generation), 35106 (solar), 35105 (geothermal)

Ownership: 95% foreign ownership allowed for power generation. The remaining 5% can be held by Indonesian individuals or entities. This sector receives strong support because Indonesia is transitioning away from coal and developing its renewable energy capacity to meet climate commitments.

Licenses and process: You’ll work with the Ministry of Energy and Mineral Resources for permits. If you’re selling to the grid, you need a Power Purchase Agreement (PPA) with PLN. Grid connection timelines vary wildly by location; Java is faster, and outer islands take longer. Land acquisition or long-term lease agreements are critical and take 3–6 months to lock down.

Capital patterns: Renewable energy projects start at USD 10 million for small solar installations and go up from there. Indonesia offers feed-in tariffs for renewables, but rates are negotiated project by project. The sovereign wealth fund (Indonesia Investment Authority) co-invests in large-scale energy projects and can help de-risk early stages.

Talent and visas: You’ll need engineering expertise, some local, some expat. Environmental impact assessments (AMDAL) are mandatory for larger projects and require certified Indonesian consultants. Training programs for renewable energy technicians are expanding as the industry grows.

Local partners: The 5% local ownership can be a financial investor. Real value comes from partners who understand land rights and local government relationships.

Red flags: Land rights in Indonesia are complicated. Do serious due diligence. Make sure your land certificates are clean and your permits are from the right authorities. PPAs with PLN can take 12–18 months to negotiate; factor that into your timeline.

Natural Resources, Nickel/EV Value Chain

Business codes: 24202 (nickel smelting), 27101 (electric motors and generators), 29101 (motor vehicle manufacturing)

Ownership: Mining and smelting have specific foreign ownership limits depending on the stage of processing. Battery and EV component manufacturing can be 100% foreign-owned, making this one of the priority sectors for economic growth.

Why it matters now: Indonesia banned nickel ore exports in 2020 to force value-added processing inside the country. If you want Indonesian nickel, you process it in Indonesia. That’s why battery companies and automakers are building here. Indonesia holds about 25% of the world’s nickel reserves, positioning it as a critical link in the global EV supply chain.

Licenses and agencies: The Ministry of Energy and Mineral Resources, the Ministry of Industry, and regional investment boards all play a role. Environmental permits (AMDAL) are mandatory and take 6+ months. These are labor-intensive industries that the government prioritizes for job creation.

Capital patterns: Smelters and battery plants are multi-hundred-million-dollar investments. Indonesia offers tax holidays for these, up to 100% CIT exemption for 5–20 years depending on investment size, plus non-fiscal incentives like simplified import procedures for raw materials and equipment.

Talent and visas: Heavy industry requires specialized skills. You’ll import some expertise and train local teams. Indonesia’s vocational training programs are expanding to support this sector and develop the workforce these companies need.

Red flags: Environmental compliance is under intense scrutiny. Community relations matter; local opposition can stall projects. Make sure your supply chain doesn’t touch sanctioned entities (nickel processing has attracted controversial players).

Healthcare & Medical Devices

Business codes: 21011 (pharmaceutical manufacturing), 86101 (hospital services), 32501 (medical devices)

Ownership: Hospitals are capped at 67% foreign ownership. Medical device distribution and manufacturing can be 100% foreign. Pharmaceutical manufacturing can be 85% foreign. The growing middle class is driving demand for better healthcare services.

Licenses: Healthcare is heavily regulated. Hospital licenses come from the Ministry of Health and require Indonesian medical directors. Medical devices need registration with the National Agency of Drug and Food Control (BPOM), which takes 6–12 months. The business licensing requirements are more stringent here than in most other sectors.

Capital patterns: Medical device distribution can start lean, under USD 500,000 for setup. Hospitals require multi-million-dollar capital and are long-term plays. The government provides investment incentives for hospitals outside major cities to improve healthcare access.

Talent and visas: You need Indonesian-licensed doctors for clinical roles. Expat specialists can get practice permits but face annual quotas. Human capital development in healthcare is a priority, with training programs supported by both government and international partners.

Red flags: Don’t underestimate the time to get BPOM approval for medical products. Don’t assume your CE or FDA certification transfers directly; it doesn’t.

Tourism & F&B

Business codes: 56101 (restaurants), 79111 (travel agencies), 55101 (hotels)

Ownership: Restaurants can be 100% foreign-owned. Hotels depend on size and rating; most allow 100%. Travel agencies typically require 51% Indonesian ownership. Tourism is one of the priority sectors because it generates foreign exchange and creates jobs across multiple skill levels.

Licenses: Business licenses through OSS-RBA, plus local permits for food handling, liquor (if applicable), and tourism. Bali has additional local regulations. The business license process is straightforward for restaurants compared to regulated industries.

Capital patterns: F&B can launch on USD 200,000–500,000 for a single location. Hotels are obviously much larger. Indonesia offers attractive features for tourism investment, especially in underdeveloped regions where the government wants to encourage development.

Talent and visas: Service industry wages are low compared to Western markets, but turnover is high. Training matters. Work permits for expat managers are straightforward. Many businesses invest in training programs to improve service quality and retain staff.

Red flags: Bali looks easy but has hidden costs, local customs, unofficial fees, and intense competition. Jakarta and secondary cities often offer better unit economics for F&B.

Financial Services & Fintech

Business codes: 64110 (central banking), 64191 (commercial banks), 66121 (securities brokerage)

Ownership: Banking and insurance have specific foreign ownership caps set by Law No. 40/2007 and subsequent regulations. Most are limited to 99% foreign ownership but require approval from the Financial Services Authority (OJK). Fintech companies in the payment system space can be 100% foreign-owned depending on the specific activity.

Licenses: OJK oversees all financial services licensing. Banks need full banking licenses (very difficult for new entrants). Fintech companies need registration or licenses, depending on whether they handle funds. Payment system providers work under Bank Indonesia regulations. Expect 6–18 months for licensing, depending on complexity.

Capital patterns: Banks require massive capital, a minimum IDR 3 trillion (about USD 187 million) for new commercial banks. Fintech and payment platforms can start smaller, but still need significant investment for compliance, technology, and customer acquisition. Financial services are capital-intensive but offer high returns in a country where millions are still underbanked.

Talent: Indonesia has strong finance and accounting talent from local universities. Senior risk and compliance roles often require expat expertise initially. The Financial Services Authority requires firms to invest in training programs for local staff.

Red flags: OJK is conservative and moves slowly. Build relationships early. Financial services have strict business licensing requirements and ongoing supervision. Don’t underestimate the cost of compliance.

Manufacturing & Light Industry

Business codes: 10–33 series, depending on what you produce (food, textiles, automotive parts, electronics, etc.)

Ownership: Most manufacturing is 100% open to foreign investment. Some sub-sectors related to national security or cultural heritage have restrictions. Check the Positive Investment List for your specific KBLI.

Why Indonesia: Indonesia offers a favorable environment as a production base for export and domestic sales. Labor costs are competitive with Vietnam and lower than Thailand. The country is part of the RCEP and ASEAN trade agreements, giving tariff-free access to huge markets. Raw materials for industries like palm oil, rubber, and textiles are locally available. The strategic location between Asia and Australia reduces shipping times and costs.

Licenses: Standard business licensing through OSS-RBA. If you’re importing machinery or raw materials, you’ll work with customs and may qualify for import duty exemptions under bonded zone or export-oriented policies. Environmental permits (UKL-UPL for smaller operations, AMDAL for large facilities) are required.

Capital patterns: Light manufacturing (garments, food processing, assembly) can start at USD 1–5 million. Automotive or heavy industry requires USD 50–500 million. Indonesia provides tax incentives and investment incentives for labor-intensive industries that create jobs.

Talent: Indonesia has a large, young workforce. Medium enterprises and large factories can recruit from vocational schools and offer training programs. Labor-intensive industries benefit from lower wage costs; minimum wages vary by province, but Jakarta is around USD 300–350/month for entry-level factory workers.

Red flags: Labor regulations protect workers strongly. Termination costs are high if you need to downsize. Plan your workforce carefully. Supply chain logistics between islands can be unpredictable; factor in buffer time and inventory costs.

Construction Services & Infrastructure

Business codes: 41101 (building construction), 42101 (civil engineering), 43 series (specialized construction)

Ownership: Construction services for buildings can be 67% foreign-owned. Some infrastructure projects allow up to 100% foreign ownership depending on government regulation and project type. This is a priority sector because Indonesia is in the middle of massive infrastructure projects to connect the archipelago.

Why it’s active: The Indonesian government is spending billions on roads, bridges, ports, airports, railways, and the new capital city (Nusantara). Foreign investors and contractors are welcome, especially for large-scale projects where local companies lack technical capacity. Special economic zones are being developed across the country, requiring construction and engineering expertise.

Licenses: Construction requires a business license plus project-specific building permits from local governments. Large projects require environmental permits (AMDAL). Foreign contractors often enter through joint ventures with local construction companies that understand permitting and labor management.

Capital patterns: Small contractors can operate on USD 500,000–1 million. Major infrastructure projects require tens or hundreds of millions. Payment terms from government projects can be slow; cash flow management is critical.

Talent: Indonesia has engineering graduates and skilled tradespeople, but large projects often bring in expat specialists for design, project management, and quality control. Training programs on-site are common.

Red flags: Government procurement can be bureaucratic. Payment delays happen. Labor disputes on construction sites are common, and unions carefull monitor themy. Land acquisition for projects often causes delays.

Where to Invest, Regions & SEZs (Costs, Talent, Logistics)

Indonesia is made up of 17,000 islands. Location drives your costs, talent pool, and speed to market. The government has designated special economic zones (SEZs) with enhanced investment incentives to encourage development outside Jakarta.

Jakarta (Jabodetabek)

Jakarta is the capital and economic center. You’ll find the deepest talent pool, best infrastructure, and most suppliers. Office space in central Jakarta runs USD 20–40 per square meter per month.

Warehouses in the suburbs go for USD 3–8. Wages for skilled workers are higher than anywhere else in Indonesia, but you have access to universities, expat communities, and every industry. If you’re in tech, finance, or professional services, you’re probably starting here. The downside is traffic (brutal) and the cost of living for expats.

Jakarta Investment Center helps foreign investors navigate permits and connects them with local resources at invest.jakarta.go.id. The Jakarta regional government actively works to attract foreign direct investment and streamline business licensing.

Batam-Bintan-Karimun SEZ

This special economic zone sits near Singapore and targets manufacturing, logistics, and maritime services. The SEZ offers tax holidays, simplified customs, and lower land costs. Warehouse and factory space runs USD 2–4 per square meter. Labor costs are 20–30% below Jakarta.

The advantage is proximity to Singapore for management and supply chains, plus preferential treatment under the SEZ framework. Companies investing here get non-fiscal incentives, including faster import/export procedures and dedicated infrastructure.

The challenge is smaller talent pools; you’ll train more people from scratch. However, for businesses that want a production base serving Southeast Asian markets, the strategic location and cost advantages are compelling.

Bali

Bali is tourism, hospitality, and increasingly, digital nomads. Office and retail space in Seminyak or Canggu costs USD 15–30 per square meter. Talent for hospitality is deep, but technical skills are thin. If you’re building a resort, F&B brand, or tourism tech, Bali makes sense. For anything else, you’re flying staff in from Jakarta. The investment climate here strongly favors tourism and related services.

New Capital (Nusantara) in Kalimantan

Nusantara is the Indonesian government’s multi-decade mega-project to move the capital from Jakarta. Construction services, infrastructure projects, logistics, and technology companies are getting preferential treatment.

Right now, it’s high-risk, high-reward, land is cheap, investment incentives are generous (including tax holidays and special permits), but services and talent are nearly nonexistent. This is a 5–10 year play for investors willing to bet on government commitment to the project.

Other Strategic Locations

Surabaya (East Java) is Indonesia’s second-largest city and a manufacturing hub. Semarang (Central Java) offers lower costs than Jakarta with decent infrastructure. Makassar (Sulawesi) is growing as a logistics hub for eastern Indonesia. Medan (North Sumatra) serves as the economic center for the island. Each has local investment incentives and special economic zones tailored to specific industries.

The 8-Week Incorporation & Licensing Timeline (Realistic)

Here’s what actually happens when you set up a PT PMA, week by week. This assumes you have good advisors and no major hiccups.

Week 1–2: Foundation

Your lawyer or notary drafts your deed of establishment, the legal document that creates your company. You’ll finalize your company name (must be in Indonesian or include “Indonesia”), your business activities (KBLI codes), your shareholders, and your board structure.

Once the notary signs off, they file for Ministry of Law approval under the omnibus law framework. In parallel, you register through the OSS-RBA system to get your NIB (business identification number). Your NIB is your company’s master ID for everything else; think of it as your business license foundation.

Week 3–4: Money and Taxes

You open a corporate bank account. Most foreign investors use HSBC, Standard Chartered, or local banks like BCA or Mandiri. You’ll need your approved deed, NIB, and passport copies for directors. Once the account is open, you deposit your paid-up capital, a minimum of IDR 2.5 billion, remember.

The bank issues a letter confirming the deposit. You cannot withdraw this capital without justification; it’s for business activities. Your lawyer uses that bank letter to register for your NPWP (tax identification number) with the Directorate General of Taxes. You also register for BPJS (mandatory health and employment insurance for any Indonesian employees).

Week 5–8: Operational Licenses

Through OSS-RBA, you apply for business licenses based on your risk classification. Low-risk business activities (like consulting) get licenses automatically. Medium- and high-risk activities (like manufacturing or healthcare) trigger inspections and additional documentation under the risk-based approach.

If you need site-specific permits, factory, warehouse, or clinic, those come from local authorities and add time. Your first LKPM (investment activity report) setup happens here. LKPM is how you prove to the government that you’re deploying the capital you promised and creating jobs as planned.

What You Need

- Passport copies and photos for all directors and commissioners

- Company name options (three choices, in case your first pick is taken)

- Business plan summary with KBLI codes

- Proof of foreign shareholder entity (certificate of incorporation, good standing)

- Capital source documentation (bank statements showing you have the funds)

- Office address (lease agreement or domicile letter)

Your notary and lawyer do most of the filing. You make decisions and provide documents. Budget 8–12 weeks in reality, government systems slow down around Indonesian holidays, and banks can be picky about foreign source funds.

Taxes & Incentives, Plain-English Guide

Indonesia’s corporate income tax rate is 22% for most companies. If your company goes public and meets minimum share-float requirements, you get 19%. Small and medium enterprises with revenue under IDR 50 billion can get reduced rates on the first portion of income.

Sales tax (VAT) is 11% on most goods and services (going to 12% eventually). Withholding tax applies to dividends (20% or lower with tax treaties), interest (20%), and royalties (20%). Indonesia has double taxation treaties with over 70 countries, so check if your home country has an agreement that reduces withholding rates.

Tax Holidays and Allowances

Tax incentives are where Indonesia gets interesting for investors. If you’re investing in certain pioneer industries, data centers, integrated steel, battery production, renewable energy, you can qualify for tax holidays that exempt 50% to 100% of your CIT for 5 to 20 years. After the holiday, you get a 50% reduction for another two years. Minimum investment thresholds start at IDR 100 billion (about USD 6.2 million) for most industries, higher for others.

Tax allowances work differently. You get accelerated depreciation, extended loss carryforward (up to 10 years instead of 5), and reduced withholding tax on dividends. These apply to capital-intensive projects in specific business sectors or regions. The Ministry of Investment (BKPM) approves both holidays and allowances based on government regulation defining priority sectors.

Non-fiscal incentives accompany tax breaks for large investments. These include simplified import licenses for machinery and raw materials, guaranteed infrastructure access, and dedicated liaison officers to help with business licensing. Labor-intensive industries creating significant jobs often qualify even if they don’t meet the highest capital thresholds.

Global Minimum Tax Considerations

Global minimum tax is coming. Indonesia signed on to the OECD framework for a 15% minimum effective tax rate on multinationals. If you’re in a tax holiday and your group’s global revenue exceeds EUR 750 million, you’ll need to model whether your home country will top up the tax. This doesn’t kill the investment incentives, but it changes the math for large multinational companies.

Check the latest Ministry of Finance regulations before you apply. Rules change, and sector eligibility shifts based on government priorities for economic growth and job creation.

Hiring, Visas, & Employer Obligations (Zero-fluff)

When you hire Indonesian employees, you register them with BPJS for health insurance (BPJS Kesehatan) and employment insurance (BPJS Ketenagakerjaan). Employer contributions run about 11–12% of gross salary across both programs. Employees contribute around 3%. Payroll is typically monthly. You need employment agreements in Indonesian (Bahasa Indonesia), even if you operate in English internally.

Severance is mandatory if you terminate without cause. It’s based on years of service and can be expensive, up to 9 months of salary for long-tenured employees under Law No. 13/2003 as amended by the omnibus law. Always get legal advice before firing anyone.

Work permits for expats involve two documents: KITAS (limited stay permit) and IMTA (work permit). Your company applies through OSS-RBA once you’re incorporated. Processing takes 2–4 weeks. You pay a levy called DPKK for each expat position, around USD 100–1,200 per month, depending on the role. The Indonesian government wants you to invest in training programs and human capital development to replace expats with local talent over time.

Your annual compliance calendar includes: monthly payroll tax withholding, quarterly LKPM investment reports (proving you’re creating jobs and deploying capital), annual corporate tax returns (due four months after year-end), annual manpower reports, and annual business license renewals. Miss an LKPM, and your OSS status can get suspended, freezing business operations.

Compliance That Trips Up Foreign Investors

PDPL (Personal Data Protection Law)

If you collect, process, or store personal data of Indonesian citizens, you’re covered. This affects the digital economy broadly, e-commerce, fintech, SaaS, healthcare, and education businesses. You need a Data Protection Officer (DPO) if you’re processing large volumes or sensitive data. You need documented consent from users (pre-ticked boxes don’t count). You need a breach response plan. If you suffer a data leak, you have 72 hours to notify authorities. Cross-border data transfers require contracts proving your foreign recipient meets Indonesian protection standards.

Penalties go up to 2% of annual revenue or IDR 5 billion. Enforcement started in 2024 and is getting stricter. Budget for legal review and systems upgrades. Companies in financial services face additional oversight from the Financial Services Authority (OJK) on data handling.

LKPM Reporting Mistakes

LKPM is your quarterly report showing how much of your investment plan you’ve executed, how much capital you’ve deployed, how many workers you’ve hired (job creation), and what licenses you’ve secured. This is the government’s tool to track whether foreign businesses are delivering on their promises. Common mistakes: forgetting to file on time (you get auto-suspended), reporting capital deployment that doesn’t match your bank statements (triggers audits), and claiming incentives you didn’t properly apply for (rejection and penalties).

Set a calendar reminder. Have your accountant or company secretary own this task. Missing LKPM filings can invalidate your tax holidays and other investment incentives.

Nominee Traps

Some advisors will suggest you use an Indonesian nominee, a local person who holds shares “on your behalf” while you secretly control the company. This violates Indonesian law. If discovered, your business can be dissolved, your assets seized, and you can be banned from doing business in Indonesia. The omnibus law and increased enforcement make this riskier than ever.

If your sector requires local ownership per the Positive Investment List, find a real partner or a financial investor who’s comfortable being a passive shareholder with legal protections in your shareholder agreement. Many businesses successfully structure compliant arrangements; there’s no need to take illegal shortcuts.

Tools & Downloads

While I can’t provide downloadable files directly, here’s what you should build or request from your advisor:

KBLI & Ownership Matrix: A spreadsheet listing the business classification codes relevant to your industry, the maximum foreign ownership allowed for each per the Positive Investment List, and whether a local partnership is required.

Incorporation Checklist: Step-by-step tasks from name approval through first LKPM filing, with responsible parties and deadlines for business licensing.

Tax & Payroll Calendar: Monthly, quarterly, and annual filing deadlines for withholding tax, sales tax (VAT), CIT, LKPM, BPJS, and manpower reports. Include dates when tax incentives need renewal.

Risk Register: A tracker for compliance risks specific to your sector, PDPL deadlines, business license renewals, capital deployment milestones, environmental permits, and job creation targets for LKPM reporting.

Incentive Application Tracker: Timeline and requirements for applying for tax holidays, tax allowances, and non-fiscal incentives based on your investment size and priority sector classification.

Your lawyer or incorporation consultant should provide these. If they don’t offer them, ask. Companies that invest serious capital should also request sector-specific guidance on government regulation changes that might affect their business.

Frequently Asked Questions

Can I own 100%?

It depends on your business activity. Check the Positive Investment List (Government Regulation No. 10/2021 as amended by Regulation No. 49/2021). Most sectors, tech, manufacturing, logistics, renewable energy, and consulting, allow 100% foreign ownership. The Indonesian government opened these business sectors to encourage foreign direct investment and economic growth. Some sectors, like retail, certain healthcare services, and media, have caps (67%, 49%, or other percentages). If your sector isn’t on the restricted list, you’re good to go with full foreign ownership.

How much capital do I actually need to deposit, and when?

Minimum IDR 2.5 billion (about USD 156,000) in paid-up capital for most businesses. You deposit it after your company is legally established and your bank account is open, typically in week 3 or 4 of the incorporation process. This capital stays in your company account and can be used for business activities like rent, salaries, and equipment. Your total investment plan (paid-up capital plus future investment) must exceed IDR 10 billion per KBLI code and location, but you deploy that over time as your business grows. The Indonesian government tracks deployment through quarterly LKPM reports to ensure you’re meeting job creation and investment targets.

Do I need a local partner for my KBLI?

Look it up in the Positive Investment List published by the Indonesian government. If your KBLI has a foreign ownership cap below 100%, yes, you need an Indonesian partner for the remaining percentage. For example, if hospitals are capped at 67% foreign investment, you need an Indonesian shareholder for the other 33%. Make sure it’s a real partner who adds value, market knowledge, relationships with government agencies, and operational expertise, not a nominee. Construction services typically require local partners at 33% ownership. Financial services have specific caps set by the Financial Services Authority.

How long to get the first license?

Your NIB (business identification number) comes automatically when you register through OSS-RBA under the risk-based approach, usually within days. This serves as your foundational business license. Sector-specific licenses depend on your risk category. Low-risk activities get approved instantly. Medium- and high-risk activities require document submission and sometimes site inspections, which can take 2–8 weeks. Regulated sectors (healthcare, energy, financial services) take longer, plan for 3–6 months. Companies investing in special economic zones often get faster processing times as part of their non-fiscal incentives.

What reports do I file after go-live?

Monthly: payroll tax withholding (PPh 21) and sales tax/VAT (if applicable). Quarterly: LKPM (investment activity report) through OSS-RBA proving you’re deploying capital and creating jobs as promised.

Annually: corporate income tax return (due four months after fiscal year-end), manpower report to the Ministry of Manpower showing your workforce and training programs, and annual business license renewal. If you have expats, you also renew work permits annually.

Companies receiving tax holidays or tax incentives file additional reports to maintain their benefits. Missing LKPM is the most common mistake; it can freeze your business operations and invalidate investment incentives.

What about double taxation on profits I repatriate?

Indonesia has double taxation treaties with over 70 countries, including the US, UK, Singapore, Japan, Australia, and most European nations. These treaties typically reduce withholding tax on dividends from 20% to 10% or 15%, depending on the specific treaty and shareholding percentage.

Check if your home country has a treaty with Indonesia. You’ll need to file the proper forms and get a certificate of tax residence from your home country to claim treaty benefits. Work with a tax advisor familiar with both Indonesian and your home country tax law to structure profit repatriation efficiently.

Is Indonesia really business-friendly for foreign investors?

The investment climate has improved significantly in the past few years. The omnibus law simplified hundreds of regulations, the OSS-RBA system digitized business licensing, and the Indonesian government actively promotes foreign direct investment through agencies like BKPM and the sovereign wealth fund (Indonesia Investment Authority).

Indonesia offers competitive advantages: 280 million consumers, the growing middle class creating demand across sectors, strategic location between Asia and Australia, membership in RCEP and other trade agreements giving market access across Southeast Asian nations, abundant natural resources for manufacturing, and government regulation that prioritizes certain sectors with generous tax incentives.

Challenges remain: bureaucracy at local government levels, infrastructure gaps outside Java, and enforcement inconsistencies. But many businesses successfully operate here and find the market opportunity worth the effort. Talk to companies in your industry already doing business in Indonesia before you invest.

What sectors are the Indonesian government prioritizing?

The government identifies priority sectors in its National Medium-Term Development Plan and provides investment incentives. Current priorities include: digital economy (data centers, e-commerce, fintech), renewable energy (solar, geothermal, wind), EV value chain (batteries, components, assembly), healthcare and pharmaceuticals, food security and agriculture, tourism and creative economy, labor-intensive industries for job creation, and infrastructure projects. These business sectors get preferential treatment, faster licensing, tax holidays, access to special economic zones, and sometimes co-investment from the sovereign wealth fund.

Can I bring in equipment and machinery duty-free?

It depends. Companies in special economic zones get duty exemptions on imports used for production. Export-oriented manufacturers can qualify for bonded zone status, deferring or eliminating duties on imported raw materials and equipment. Companies receiving tax incentives for large investments often get simplified import procedures as non-fiscal incentives. Standard imports pay duties ranging from 0% to 25% depending on the goods. Work with a customs broker who understands your industry and can structure imports to minimize costs legally.

How does Indonesia compare to other Southeast Asian countries for investment?

Indonesia offers the largest domestic market in Southeast Asia, 280 million people versus 70 million in Thailand, 54 million in Myanmar, or 100 million in Vietnam and the Philippines combined. Economic growth consistently runs 5%+ annually. The growing middle class creates consumer demand that companies can’t access from smaller markets. Indonesia is also part of RCEP, giving the same regional trade access as Vietnam or Thailand.

Labor costs are competitive with Vietnam and lower than Thailand for manufacturing. Natural resources, such as nickel, tin, palm oil, natural gas, and coal, make Indonesia attractive for resource-based industries. The strategic location works well for companies serving both Asian and Australian markets.

Challenges: Infrastructure lags in Vietnam and Thailand, especially outside Java. Business licensing has improved, but local government coordination can be frustrating. Indonesia’s economy is less export-dependent than Vietnam, which matters if you’re building a production base primarily for export. For companies targeting the domestic Southeast Asia consumer market or needing natural resources, Indonesia often wins. For pure export manufacturing, Vietnam or Thailand might be simpler.

Do I need a physical office or can I use a virtual office?

You need a legitimate business address for incorporation, but whether you need a physical office depends on your activities and local regulations. Service businesses and digital economy companies often start with serviced offices or co-working spaces, these are acceptable for business licensing as long as the provider gives you a proper domicile letter.

Manufacturing, warehousing, healthcare, and retail obviously need real facilities. Financial services regulated by the Financial Services Authority require physical offices that meet minimum standards. Some local governments (especially Jakarta) audit addresses and reject virtual offices that are just mail drops.

For your first year, a serviced office works if your business model allows it. As you grow and hire staff, you’ll probably want your own space. Budget USD 10–30 per square meter per month for decent serviced offices in Jakarta, less in secondary cities.

What happens if I want to exit or sell my business?

You can sell your shares to another foreign investor or to an Indonesian buyer (if sector rules allow). Share transfers require notary documentation and filing with the Ministry of Law. Suppose you’re selling to a buyer who will change the ownership structure beyond sector limits (e.g., selling a 100% foreign company to an Indonesian who makes it 100% local). In that case, you need to update your company classification.

Liquidating and closing the company is more complex. You need to settle all tax obligations, file final returns, clear BPJS, settle employee contracts (including severance if you’re terminating staff), and go through a formal dissolution process that takes 3–6 months minimum. The government will audit your LKPM reports to ensure you meet investment commitments. If you underperform significantly, there could be penalties or claw-back of incentives.

Many foreign investors prefer selling to a buyer rather than liquidating, as it’s faster and cleaner. Make sure your shareholder agreement (if you have partners) includes exit provisions from the start.

Ready to Invest in Indonesia?

If you’re in the digital economy, renewable energy, manufacturing, or any sector where Indonesia’s natural resources, strategic location, and growing middle class create advantages, this is your moment. The investment climate is the best it’s been in decades. The Indonesian economy is growing steadily. Infrastructure is improving. Human capital development is producing better-trained workers.

Do your homework. Talk to lawyers and accountants who work with foreign businesses daily. Visit the regions where you plan to operate. Build relationships with government agencies and local partners before you need them. Understand the compliance requirements and budget for them. Plan realistically, Indonesia takes longer than you expect, but the market rewards patience.

The investors who succeed here think long-term, adapt to local conditions, and commit to creating jobs and building real businesses. If that’s you, Indonesia offers one of the best risk-reward opportunities in Southeast Asia. Start now.

Ready to Apply or Extend Your Visa?

Let our visa specialists handle your application.