Tax Treaty Indonesia-Singapore: Avoid Double Taxation

The Indonesia–Singapore Double Taxation Agreement (DTA) is the main rulebook that prevents the same income from being taxed twice and sets out which country may tax what. The treaty was updated and signed on February 4, 2020, entered into force on July 23, 2021, and generally applies from January 1, 2022.

Separately, certain BEPS Multilateral Instrument (MLI) provisions began applying earlier (December 26, 2020). Today’s anti-abuse guardrail is built into the updated DTA itself, via a Principal Purpose Test (Article 28), so substance matters.

What changed for taxpayers? The revision modernizes withholding tax outcomes, clarifies capital gains and interest exemptions in specific government-related cases, and refreshes permanent establishment rules, including a services PE threshold of 90 days in any 12-month period. For residency tie-breakers, companies no longer rely on an automatic “place of effective management”; instead, cases are resolved by mutual agreement between authorities.

To actually claim relief in Indonesia, ditch the old DGT-1/DGT-2: use the single Form DGT with a Certificate of Residence (CoR) from Singapore. This guide walks you through eligibility, rates, paperwork, and practical examples, so you can apply the treaty correctly and confidently.

Table of Contents

What’s New vs. Old: Treaty Timeline & Key Changes

Let’s rewind the clock. The original Indonesia Singapore DTA started back in 1990-1992, but it was getting pretty outdated for modern professional services and digital economy needs. Fast-forward to February 4, 2020 – that’s when both countries signed the shiny updated tax treaty.

But here’s the thing about tax treaty agreements: signing is just step one. The real magic happens when they actually take effect. This new tax treaty became legally binding after both countries completed their ratification processes. The effective dates vary depending on what type of tax we’re talking about, but most businesses started seeing benefits in 2021.

What changed? The headline improvements include:

- Royalty rates slashed to 10% or 8% (down from higher domestic law rates)

- Branch profit tax rate capped at 10%

- Smarter residency tie-breaker rules for permanent establishment determination

- Anti-abuse measures, including the principal purpose test, that protect legitimate businesses while stopping tax evasion

- Enhanced relevant provisions for scientific equipment and commercial or scientific equipment

Think of it like upgrading from an old flip phone to a smartphone. Same basic function of preventing double taxation, but way more sophisticated and user-friendly.

Scope at a Glance

This tax treaty covers the main taxes that hit cross-border business. In Indonesia, we’re talking about the Indonesian tax on income tax and individual income tax. In Singapore, Singapore corporate and individual income taxes fall under the treaty’s protection.

Who gets to use these benefits? Only residents of either country can claim tax treaty benefits. Sounds obvious, but it’s crucial. If you’re not a resident of Indonesia or Singapore under their respective tax rules, this treaty won’t help you avoid double taxation.

The relevant provisions also cover specialized areas like:

- Operation of ships in international traffic

- Television or radio broadcasting and radio broadcasting royalties

- Capital gains from shares traded on recognized exchanges

- Gains derived from immovable property and movable property

- Income from government bonds and government institutions

The treaty also plays a nice role in Singapore’s MLI positions. The MLI updates now apply to this DTA, mainly around principal purposes testing and anti-abuse rules.

Residency Rules & Certificates (How to Qualify)

Getting residency right is absolutely critical because it’s your ticket to tax treaty benefits. Mess this up, and you’re back to paying full domestic law tax rate instead of enjoying tax exemption or reduced rates.

For individuals: You’re generally a resident where you live most of the year or have your strongest personal and economic ties. The treaty has tie-breaker rules if both countries want to claim you as a resident. First, it looks at where you have a permanent home. It checks your center of vital interests if that doesn’t settle it. Still tied? Then it’s about where you spend more time.

For companies: You’re typically a resident where you’re incorporated or where your management and control happens. The tie-breaker for companies considers where your place of effective management is located and whether you qualify as an associated enterprise.

Documents You MUST Have

Getting the paperwork right isn’t optional – it’s everything for claiming tax exemption or reduced withholding tax rates.

Singapore Certificate of Residence (COR)

This is your golden ticket when claiming benefits on Indonesian-source income. You apply through IRAS (Singapore tax authority), but don’t expect rubber-stamp approval. They’re getting stricter about who qualifies to avoid tax evasion schemes.

When you need it: Whenever you’re receiving dividends, interest, royalties, or such income from Indonesia and want the tax treaty rates instead of the higher domestic law withholding tax.

Indonesia DGT-1/DGT-2 Forms

These forms are how you actually claim the tax treaty benefits in Indonesia. Think of them as your formal request to the Indonesian tax authorities to apply a reduced tax rate instead of the full tax imposed under domestic law.

DGT-1 vs DGT-2: The difference matters for different types of income. DGT-1 is for most standard tax treaty benefits. DGT-2 is for more complex situations, like production sharing contracts or where additional documentation is needed.

Common mistakes to avoid:

- Don’t ask IRAS to stamp the DGT forms – that’s not required under the relevant provisions

- Always attach your Singapore COR to prove beneficial owner status

- Make sure the information matches between your COR and DGT forms to pass the principal purpose test

Permanent Establishment (PE) & Service PE

A permanent establishment is basically a fancy tax term for “you’re doing enough business in the other country that they want to tax you there too.” Understanding PE rules helps you avoid accidentally creating a tax obligation where you don’t want one.

What creates a PE under the tax treaty:

- Business property: An office, branch, or factory that’s permanent

- Construction projects: Generally if they last more than 6 months

- Dependent agents: Someone who regularly concludes contracts on your behalf

- Service PE: Providing professional services or consulting services for more than 183 days in any 12-month period

Here’s where it gets practical for professional services. Let’s say your Singapore tech company is doing scientific work in Indonesia. If your team is there for 8 months, you’ve likely created a service permanent establishment. That means Indonesia can tax the profits from that project under Indonesian tax rules.

Risk flags for cross-border teams:

- Long-term client engagements in consulting services

- Having local staff who can sign contracts

- Maintaining inventory or scientific equipment in the other country

- Providing services that go beyond just advice

The key is planning ahead. Know these thresholds and structure your operations accordingly to avoid unwanted tax imposed by creating a permanent establishment.

Withholding Tax (WHT) Rate Table — Treaty vs Domestic

This is where the rubber meets the road. These are the actual tax rates you’ll pay on different types of cross-border income:

| Income Type | Indonesia Domestic Rate | Tax Treaty Rate | Singapore Domestic Rate | Tax Treaty Rate |

| Dividends | 20% | 10% (≥25% ownership)<br>15% (other cases) | 0%* | 0%* |

| Interest | 20% | 10%<br>0% (government institutions) | 15%** | 10% |

| Royalties (industrial commercial) | 20% | 10% | 10% | 10% |

| Royalties (copyright/patents) | 20% | 10% | 10% | 10% |

| Royalties (equipment/technical) | 20% | 8% | 10% | 8% |

| Branch profit tax | 20% | 10% | N/A | N/A |

| Capital gains | Varies | Exempt/** subject** to conditions | 0%*** | Exempt |

Singapore generally doesn’t impose withholding tax on dividends paid to non-residents *Singapore’s withholding tax on interest applies mainly to certain securities ***Singapore generally doesn’t tax capital gains for non-residents

Special Categories:

- Scientific equipment: May qualify for tax exemption under specific relevant provisions

- Television or radio broadcasting royalties: Subject to industrial commercial rates

- Cinematograph films: Generally taxed as royalties at standard rates

- Government bonds: Interest received may qualify for tax exemption

- Operation of ships in international traffic: Generally exempt from tax

Key Eligibility Requirements:

- Beneficial owner status is required for all income types

- Principal purpose test: The arrangement can’t have tax avoidance as the main purpose

- Substance requirements: You need real business operations in regard to the income

Anti-Abuse & Substance (Principal Purpose Test)

The tax treaty benefits aren’t automatic – you need to prove you deserve them. The anti-abuse rules stop people from creating artificial structures just to get lower tax rates and avoid tax evasion allegations.

Principal Purpose Test (PPT): This is the big one. If getting tax treaty benefits was one of the principal purposes for your business structure, you might get denied. The competent authorities will look at relevant facts, including:

- Commercial rationale for the structure

- Whether the structure would exist without tax benefits

- Substance of operations in the treaty country

Beneficial owner requirements: You need to be the real owner of the income. If you’re just receiving dividends to pass them along to someone else, you’re probably not the beneficial owner under tax treaty provisions.

Substance requirements – what tax authorities want to see:

- Real business operations and activities

- Local management is making actual decisions

- Employees performing meaningful scientific work or services

- Physical presence, such as offices or scientific equipment

- Independent decision-making authority

Red flags that trigger benefit denials:

- Shell companies with no similar operation or substance

- Structures existing only to reduce the tax imposed

- Lack of commercial rationale beyond tax benefit

- No real services provided in the treaty country

Step-by-Step: Claiming Benefits (Both Directions)

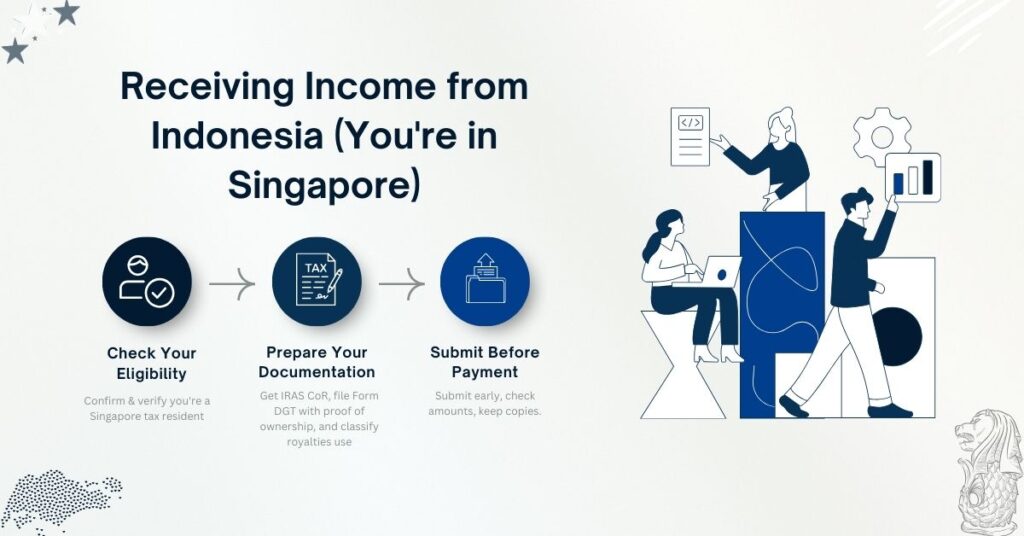

Receiving Income from Indonesia (You’re in Singapore)

Step 1: Check Your Eligibility

- Confirm you’re a Singapore tax resident

- Verify the income type qualifies for tax treaty benefits

- Check the applicable tax treaty tax rate

Step 2: Prepare Your Documentation

- Get your Singapore Certificate of Residence from IRAS

- Have the Indonesian taxpayer prepare DGT-1 or DGT-2 forms

- Provide evidence of beneficial owner status

- For royalties: Specify if industrial, commercial, or scientific use

Step 3: Submit Before Payment

- The Indonesian withholding agent must have the forms before payment

- Ensure gross amount calculations are correct

- Keep copies for the competent authorities if reviewed

Receiving Income from Singapore (You’re in Indonesia)

Step 1: Confirm Tax Treaty Eligibility

- Verify you’re an Indonesian tax resident

- Check if income qualifies and what tax rate applies

- Gather evidence of beneficial owner status

Step 2: Provide Documentation

- Give your Indonesian Certificate of Residence to the Singapore payer

- Follow IRAS’s DTA relief procedures for withholding tax reduction

- For capital gains: Determine if exempt under treaty provisions

Worked Examples (Crystal-Clear Scenarios)

Example 1: Industrial Software Royalty from Indonesia to a Singapore Company

The Setup: Your Singapore software company licenses industrial commercial technology to an Indonesian manufacturer for $500,000 annually.

Without a Tax Treaty (Indonesian Tax Domestic Law Rate):

- Withholding tax: $500,000 × 20% = $100,000

- Net received: $400,000

With Tax Treaty Benefits:

- Industrial commercial royalty tax rate: 10%

- Withholding tax: $500,000 × 10% = $50,000

- Net received: $450,000

- Your savings: $50,000

Paperwork Flow:

- Establish beneficial owner status

- Get Singapore COR from IRAS

- Indonesian licensee prepares DGT-1 form

- Specify the industrial-commercial nature of royalties

- Indonesian tax authorities apply a 10% tax rate

Example 2: Interest Paid to Singapore Government Institution

The Setup: An Indonesian mining sector company borrows $2 million from the Bank Indonesia Singapore branch at 8% interest annually.

Without Tax Treaty:

- Annual interest: $160,000

- Indonesian tax withholding: $160,000 × 20% = $32,000

- Interest received: $128,000

With Tax Treaty (Government Exemption):

- Withholding tax rate: 0% (for qualifying government institutions)

- Interest received: $160,000

- Your tax savings: $32,000

Documentation Required:

- Proof of government entity status

- Certificate showing qualification for tax exemption

- Proper DGT forms filed with Indonesian tax authorities

Example 3: Branch Profit Tax on After-Tax Profits

The Setup: Your Singapore company’s Indonesian branch earned $1 million profit and wants to remit after tax profits back to Singapore.

Under Domestic Law:

- Branch profit tax: $1,000,000 × 15% = $150,000

- Net remittable after tax profits: $850,000

Under The New Tax Treaty:

- Branch profit tax rate: $1,000,000 × 10% = $100,000

- Net remittable after tax profits: $900,000

- Your tax savings: $50,000

Example 4: Capital Gains on Shares Traded

The Setup: Your Singapore investment firm sells shares traded on the Jakarta Stock Exchange, realizing $300,000 gains derived from the sale.

Analysis under Tax Treaty:

- Capital gains from shares traded on recognized exchanges

- Generally exempt under tax treaty provisions

- Indonesian tax: $0 (vs. potential domestic law tax imposed)

- Your benefit: Full gains retained

Key Requirements:

- Shares must be traded on a recognized exchange

- The beneficial owner must be a treaty resident

- The principal purpose test must be satisfied

Ready to Apply or Extend Your Visa?

Let our visa specialists handle your application.