Business Registration Number Indonesia Guide

If you plan to run a company in Indonesia, the Business Registration Number/Nomor Induk Berusaha (NIB)is your legal foundation. It functions as your company’s identity, import license, and access key to government systems, all in one number.

Many entrepreneurs assume the process is slow and complex. In reality, with the right preparation, the full company setup typically takes 4–6 weeks, and in some cases can be shortened to 2–3 weeks. This guide walks you through the exact process, from name approval to NPWP and NIB issuance, so you know what really happens behind the system.

Before we get into the steps, you need to understand what the NIB actually activates once it’s issued.

Quick facts you can trust

Under Government Regulation Number 24 of 2018, the OSS system issues the NIB after you register and complete the required data. The NIB is a 13-digit number with security and an electronic signature. It is used to access business permits (business license + commercial/operational license paths), and it can also work as an importer identification number (API) and customs access in certain contexts.

That’s why people also call it a company registration number or a company registration certificate, because it’s the main ID that shows the business is officially recognized in the OSS flow.

Table of Contents

What Is the Business Registration Number (NIB) in Indonesia?

The Business Registration Number in Indonesia, officially known as Nomor Induk Berusaha (NIB), is the primary identification number issued to every registered business through the government’s Online Single Submission (OSS) system. Once a company formalizes its existence by obtaining this number, it receives legal recognition from the Indonesian government and can begin conducting business legally.

What the NIB Does

When a company obtains its registration number in Indonesia, the NIB automatically functions as:

- The company’s official business identity number

- Import Identification Number (API) for businesses involved in importing goods

- Customs access registration for interaction with Indonesia’s customs system

- Automatic entry into government licensing and compliance databases

This integration simplifies conducting business activities, allowing companies to avoid applying for multiple registrations separately.

Who Needs an NIB?

The Nomor Induk Berusaha (NIB) is required for nearly all companies operating in Indonesia, including:

- PT PMA (foreign-owned companies)

- PT PMDN (local companies)

- Individual or sole proprietorship businesses

- Micro, small, and medium enterprises (UMKM)

- Certain representative offices and commercial entities

Without an NIB, businesses cannot legally begin conducting business, apply for licenses, open corporate bank accounts, hire employees formally, or perform regulated business activities.

How the NIB Fits Into Indonesia’s Licensing System

The registration number in Indonesia is the first and most essential step in the country’s risk-based licensing framework. After obtaining the Nomor Induk Berusaha (NIB), additional permits may be required depending on the company’s risk classification:

- Low-risk: The NIB alone is usually sufficient for basic business operations

- Medium-risk: Requires a Standard Certificate after the NIB is issued

- High-risk: Requires full licensing and regulatory approval before conducting business activities

Because of this structure, the NIB acts as the gateway to regulatory compliance and legal operation for all companies operating in Indonesia.

Required documents (what you should prepare before you start)

This is the part that saves time. If your documents are clean, the entire process is smoother.

- Proposed company name (for legal entities) and proof of name approval from the Ministry of Law and Human Rights

- Deed of Establishment/business establishment deed (and your company’s articles / Articles of Association), notarized

- Tax Identification Number (NPWP) / taxpayer identification number (crucial for tax-related activities)

- Responsible person identity data (for individuals, OSS references NIK)

- A clear list of your business activities and the right KBLI codes (your risk level depends on this)

- Your core business details (including business address, contact info, and basic operations info)

- If you will hire foreign employees, be ready for the foreign worker plan steps (RPTKA is handled through the system flow)

How to Obtain a Business Registration Number NIB

If you’re forming a company (not just registering as an individual), the registration process usually looks like this:

Step 1: Submit your proposed company name for approval.

The first step is typically company name approval through the Ministry of Law and Human Rights. This checks that your proposed company name is unique and acceptable.

Step 2: Prepare a Deed of Establishment and notarize it.

After name approval, you prepare the Deed of Establishment (including the Articles of Association). A notary drafts and notarizes it. This is a key legal document that supports your company’s legal status.

Step 3: Obtain your Tax Identification Number (NPWP).

NPWP is essential for all tax-related activities. It’s also tightly connected to OSS registration steps, so missing NPWP can slow you down.

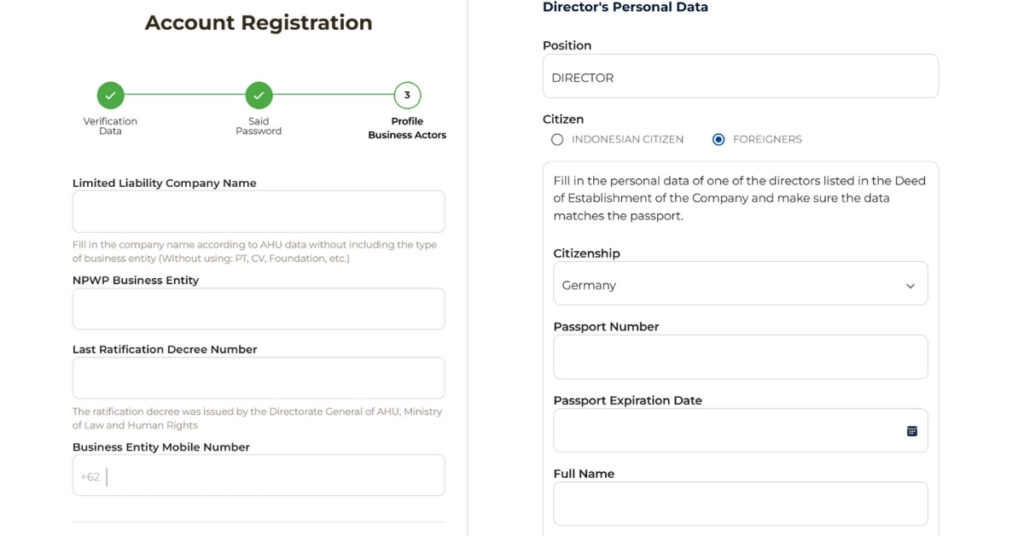

Step 4: Create your OSS account and apply for the NIB.

Once your core data is complete, you use the online single submission OSS platform to submit the application and obtain the business identification number NIB. Under the GR 24/2018 framework, OSS issues the NIB after registration data is complete and the NPWP is in place.

Step 5: Finish licensing outputs based on risk.

For low risk, the NIB may be enough to start operating. For other risk levels, you may need extra outputs (like a Standard Certificate) or other approvals, depending on your business activities and sector.

That’s the entire process in plain language. It’s still paperwork, but it’s not a mystery.

NIB vs NPWP vs “legal status” (easy way to separate them)

A lot of confusion comes from mixing three different IDs:

NIB (business registration number NIB / NIB business identification number).

This is your unique business registration number inside the online single submission system (OSS). It is the number of government portals expected when you’re dealing with licensing steps, updates, and many administrative procedures.

NPWP (tax identification number/tax identification number NPWP / taxpayer identification number).

This is your tax ID. It is essential for all tax-related activities in Indonesia. OSS even explains that if you don’t have NPWP yet, the OSS process can support NPWP processing, because NPWP is tied to registration.

Company’s legal status (your company’s legal existence).

For a formal business entity like a PT, legal existence is built through legal formation steps: company name approval, a notarized deed of establishment (business establishment deed), and approvals recorded by the Ministry of Law and Human Rights. This is what turns a proposed company into a legally formed company with “company’s articles” (articles of association) and an official company name.

So yes: NPWP and business address details matter, but they don’t replace your registration number (NIB). They work together.

Why the NIB matters so much (and what can go wrong without it)

The NIB serves as proof that a business is recognized in the state’s licensing flow, and it is central for interactions with Indonesian government agencies through OSS, because it’s the ID used to access and fulfill licensing requirements.

And there’s a practical risk if you ignore it. Business registration guidance warns that without a valid NIB, businesses can face serious enforcement consequences during inspections, including being deemed not legitimate in regulatory terms.

To keep this accurate and not scary for no reason: enforcement often shows up as administrative sanctions, warnings, suspension of activities, or revocation/freeze of licensing access, rather than a company magically “disappearing.” OSS even publishes guidance on recording sanctions and revocations in the system, signaling this is an active compliance area.

So the smart mindset is simple: registering a company formalizes the business. It protects your company’s operations and makes it easier to work with investors, clients, platforms, and government agencies, local or foreign alike.

Ready to Apply or Extend Your Visa?

Let our visa specialists handle your application.