What Expats Need to Know About Indonesia QRIS

Indonesia QRIS (Quick Response Code Indonesian Standard) is the country’s unified digital payment system that revolutionizes how people pay and receive payments. This innovative payment system lets you complete seamless transactions at millions of QRIS merchants with just one scan using your mobile phone.

Why does this digital payment system matter? It drives financial inclusion, supports small businesses and medium enterprises, and transforms Indonesia into a cashless economy. Street vendors who couldn’t afford traditional payment systems can now accept payments digitally. Indonesian tourists don’t need multiple payment applications when traveling across Southeast Asia.

Here’s how QRIS serves users: You see a QRIS code at any merchant, scan it with your digital wallet or banking app, confirm the transaction value, and you’re done. The payment system service providers handle the rest, moving funds securely through the existing payment systems infrastructure.

What Is QRIS?

QRIS stands for Quick Response Code Indonesian Standard, Indonesia’s national standard for QR code payments. Bank Indonesia (the central bank) developed this digital payment system working with the Indonesian Payment System Association and major payment service providers.

Before QRIS, merchants needed separate QR codes for different payment providers. This fragmented approach created barriers for small businesses trying to accept payments digitally. The answer lies in QRIS: one QR code that works with all major Indonesian payment applications.

Bank Indonesia rolled out QRIS on August 17, 2019, to make all QR payments work the same way. From January 1, 2020, providers had to use QRIS, so every major wallet and bank app could accept the same QR, helping the digital economy grow faster.

What Makes QRIS Popular in Indonesia? (Adoption Drivers)

QRIS didn’t become Indonesia’s dominant payment method by accident. Several factors combined to create the perfect environment for rapid adoption across the country.

Universal Merchant Access

Before QRIS, small businesses faced a painful choice: accept only cash, or sign up with multiple e-wallet companies and display several different QR codes. QRIS solved this with true ubiquity, one QR code that works with every major payment app in Indonesia.

This dramatically simplified merchant onboarding. A street food vendor no longer needs to understand the differences between GoPay, OVO, and Dana payment systems. They just need one QRIS code, and customers can pay with whatever app they prefer.

Transparent Cost Structure

Unlike credit card terminals with complex fee structures, hidden costs, and expensive equipment, QRIS offers predictable pricing. The MDR (merchant discount rate) caps are clearly published, typically 0.7% or less, and merchants know exactly what they’ll pay.

Traditional card payment systems often charge setup fees, monthly rental fees for terminals, plus transaction fees that vary by card type. QRIS eliminates most of these complications with straightforward, percentage-based pricing that small businesses can understand and budget for.

Frictionless User Experience

QRIS payments happen in seconds. Customers open their familiar banking app or digital wallet, scan the code, confirm the amount, and they’re done. No PIN entry, no signature, no waiting for card processing.

The learning curve stays minimal because people use apps they already know. There’s no new payment method to learn, just scan and pay. This simplicity drives adoption among users who might be intimidated by more complex digital payment methods.

Network Effects and Ecosystem Growth

QRIS benefits from powerful network effects. As more merchants accept QRIS, more consumers want to use digital payment apps. As more consumers use these apps, more merchants want to accept QRIS. This creates a self-reinforcing cycle of growth.

Major banks and super-apps (like Gojek and Grab) promoted QRIS heavily, bringing their massive user bases into the system. When these platforms integrated bill payment, online shopping, and offline retail through QRIS rails, it became the universal payment infrastructure for Indonesia’s digital economy.

Policy Support and Digital Inclusion Goals

Bank Indonesia actively promoted QRIS as part of broader financial inclusion initiatives. The central bank wanted to bring unbanked populations into the formal financial system, and QRIS provided an accessible entry point through mobile phones.

Government policy encouraged cash-light transactions for better economic transparency and tax collection. QRIS supported these goals while providing benefits to users, creating alignment between policy objectives and market incentives.

The COVID-19 pandemic accelerated adoption as people sought contactless payment methods. Government support for digital payments during this period helped establish QRIS as the preferred alternative to cash transactions.

Tourism and Cross-Border Growth

Indonesia’s tourism industry embraced QRIS as international visitors sought convenient payment methods. Rather than carrying large amounts of cash or dealing with currency exchange, tourists could use QRIS for everything from street food to hotel payments.

Cross-border partnerships with Malaysia, Thailand, and Singapore expanded QRIS utility for Indonesian travelers, creating additional incentives for domestic adoption. As these international connections grow, QRIS becomes more valuable for both residents and visitors.

Types of QRIS Payment (Clean, Practical Breakdown)

QRIS isn’t just one payment type; it’s a flexible system supporting multiple transaction types. Understanding these different modes helps you choose the right approach for different situations.

Person-to-Merchant (P2M) Payments

Static QR Codes are the most common type you’ll see. These printed or laminated codes never change and work indefinitely. You scan the code, manually enter the payment amount, and confirm. Static QR codes work perfectly for small businesses with simple transaction needs.

Dynamic QR Codes are generated fresh for each transaction, usually on POS terminal screens or mobile devices. These codes already contain the exact transaction amount and detailed merchant information. Dynamic codes provide better record-keeping and reduce input errors, making them ideal for businesses with complex transactions or inventory systems.

Person-to-Person (P2P) Transfers

Many digital wallets let you send money to friends and family using QRIS codes. The recipient generates a QR code in their app, you scan it and enter the amount you want to send. Transaction limits vary by payment provider, some allow up to Rp20 million daily for verified users.

P2P transfers through QRIS often have lower fees than traditional bank transfers, making them popular for splitting bills, paying back loans, or sending money to relatives.

Cash-In and Cash-Out Services

Some payment providers support cash deposits and withdrawals through QRIS codes at participating agents, mini-markets, or ATMs. You scan a code, hand over cash to the agent, and your digital wallet gets credited instantly.

This service proves crucial for people without bank accounts who want to participate in the digital economy. They can convert cash to digital money for online purchases, then withdraw unused balances later.

Bill Payment and Commerce Integration

QRIS supports utility bill payments, online shopping checkouts, food delivery orders, and vending machine transactions. Many services that previously required separate payment apps now work through the unified QRIS infrastructure.

This integration means you can pay your electricity bill, order food delivery, and buy coffee from a vending machine all using the same payment app and QR scanning process.

Cross-Border QRIS Transactions

In participating countries, you can use your Indonesian payment apps to pay at foreign merchants, and foreign tourists can use their home country apps at Indonesian QRIS merchants. Currently limited to Malaysia, Thailand, Singapore, and pilot programs in other countries.

Cross-border transactions typically include currency conversion fees and may have different transaction limits compared to domestic QRIS payments. Check with your payment provider for specific international usage terms.

Note: Specific features, limits, and availability vary by payment service provider. Always check your app’s terms and conditions for the most current information about supported transaction types and limits.

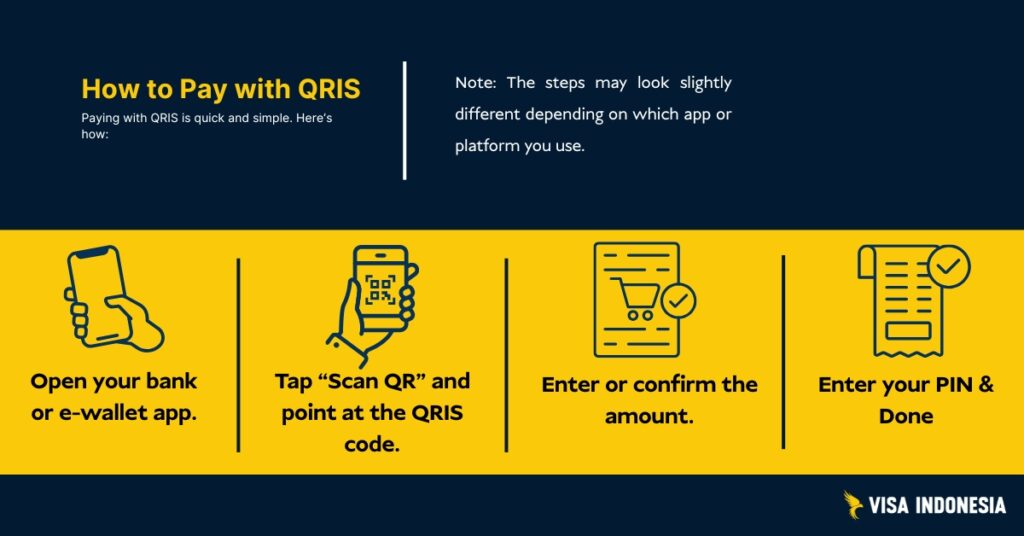

How QRIS Works (Scan-to-Pay in One Picture)

The Two Types of QR Codes

Static QRIS codes are printed once and never change. You’ll find these at local warungs and street vendors. Customers scan the code and manually enter the transaction value they want to pay.

Dynamic QRIS codes generate fresh for each transaction, usually displayed on mobile phone screens or POS terminals. These codes already contain the exact transaction value and merchant details.

The Transaction Process

When you scan and pay, the payment system executes this seamless process: Your app sends the payment request through QRIS infrastructure to the merchant’s payment service providers. They verify funds, get authorization, and then transfer funds instantly. Both parties receive confirmation, completing the cashless payment cycle.

Bank Indonesia designed this digital payment system around convenience, security, and reliability principles. The system processes millions of QRIS transactions daily, maintaining 99.9% uptime across remote areas and major cities.

Tourists & Foreign Residents: Using QRIS in Indonesia

International Tourist Options

Option 1: Visitors from Malaysia, Thailand, or Singapore should check if their home payment applications support QRIS cross-border transactions. Look for merchants displaying both country logos.

Option 2: Download popular Indonesian digital wallets such as GoPay, OVO, or Dana. Some may allow foreign users to register with a passport, but top-up options vary. Most require a local bank account, cash deposit through agents, or transfer from an Indonesian account. Basic verification usually involves identity details and an active mobile phone number registered in Indonesia.

Option 3: Some international banks with Indonesian presence offer local payment features through their global payment applications.

Foreign Residents in Indonesia

Open local bank accounts or digital wallets with full Indonesian Payment System Association member institutions. Complete identity verification with passport and local address proof. Once approved, access QRIS payments everywhere, from street vendors to luxury malls.

Common challenges include mobile phone SIM registration requirements and varying identity verification standards between payment providers. Start early and maintain backup payment methods during approval processes.

Cross-Border QRIS

QRIS cross-border capabilities are expanding across Southeast Asia, though implementation varies by country. Here’s what actually works for international stakeholders:

Current Cross-Border Coverage

- Malaysia: Indonesian tourists can use QRIS at participating merchants accepting local payment systems.

- Thailand: Limited pilots in Bangkok and tourist areas

- Singapore: Testing phase with major retailers

- South Korea: Early discussions through bilateral agreements

- Japan: Expanding beyond initial tourism-focused pilots

The US Trade Representative has noted these developments as positive examples of payment system modernization, while monitoring for any potential trade barriers.

For Indonesian Tourists Abroad

When traveling to connected countries, look for the QRIS logo at participating merchants. Your Indonesian digital wallets work directly, with automatic currency conversion at competitive rates. Transaction value limits may differ from domestic QRIS transactions.

Foreign Visitors Using QRIS

Availability depends on bilateral agreements. Malaysian tourists can often pay directly using their home country’s payment applications. Others typically need local Indonesian digital wallets, which may require basic identity verification using mobile phone numbers and passport details.

Cross border transaction fees vary by payment providers, typically 1-3% for currency conversion plus foreign exchange spreads.

Limits, Settlement, Refunds & Disputes

Transaction Value Limits

QRIS itself doesn’t restrict spending; your payment providers set these limits. Most digital wallets allow Rp2-20 million daily transaction value, while business accounts often have higher limits for medium enterprises.

When QRIS Merchants Get Paid

Most QRIS transactions settle next business day through the existing payment systems infrastructure. Some payment service providers offer same-day settlement for higher fees, crucial for small businesses managing cash flow.

Dispute Resolution

Refunds and disputes go through the merchant’s payment service providers. For quick resolution, approach QRIS merchants first, they can often process instant refunds. Complex disputes require documentation and follow Bank Indonesia’s resolution framework.

Each payment provider maintains customer service processes aligned with central bank regulations, ensuring consistent dispute handling across the digital payment system.

Security & Compliance (What Keeps You Safe)

QRIS uses bank-grade security following international standards. Every cashless payment transaction uses encryption and EMV compliance, the same global standards protecting chip card payments worldwide.

Practical Safety for QRIS Payments

Here’s how to stay secure:

- Verify merchant names on your mobile phone before confirming payments

- Only scan legitimate QRIS codes, avoid photos or suspicious printouts

- Use official payment applications from authorized payment providers

- Cancel immediately if anything seems wrong during the transaction process

Watch for “QR swapping” fraud, criminals replacing real QRIS codes with fake ones. The merchant name displayed during QRIS transactions should match where you’re shopping.

Your payment data stays protected under Indonesian banking regulations. Legitimate payment service providers cannot sell transaction histories to third parties, maintaining privacy in the digital economy.

Industry Impact: Financial Inclusion & Digital Economy Growth

QRIS transforms Indonesian commerce by enabling financial inclusion across all business sizes. 39.3 million merchants, from remote area vendors to major retail chains, now accept payments. The transaction value has grown exponentially since Bank Indonesia launched the system in 2019.

Why Small Businesses Embrace QRIS

Before this digital payment system, accepting cashless payments required expensive terminals or multiple partnerships with different payment providers. Now, small businesses can receive payments from any digital wallet using simple printed QR codes.

This creates unexpected benefits beyond convenience. Digital payment histories help small businesses build credit profiles, qualifying them for better financing options. Many banks now offer loans partially based on QRIS transaction data, supporting business growth.

The shift toward QRIS payments improves financial inclusion dramatically. People without traditional bank accounts can participate in the digital economy through accessible digital wallets, expanding economic opportunities in remote areas.

Supporting Medium Enterprises

Medium enterprises benefit from QRIS integration with existing payment systems infrastructure. Advanced analytics help optimize inventory, understand customer behavior, and streamline accounting processes. The low cost structure makes digital transformation accessible regardless of business size.

Common Problems & Quick Solutions

“Scan Failed” or “QR Code Not Recognized”

Usually caused by poor lighting, camera focus issues, or payment application compatibility. Try cleaning your mobile phone camera lens, moving closer to the QRIS code, or switching to a different digital wallet.

“Payment Pending” During Transaction Process

Network delays occur, especially during peak usage periods. Wait 2-3 minutes before attempting another QRIS payment. If payment completed but QRIS merchants didn’t receive confirmation, both parties should check transaction histories before trying again.

“Merchant Name Mismatch” Warnings

This security feature protects against fraud. If the name displayed during QRIS transactions doesn’t match where you’re shopping, cancel immediately. This could indicate fraudulent QR codes replacing legitimate ones.

Delayed Settlement to QRIS Merchants

Settlement timing depends on your payment service providers. Instant settlements are possible but not guaranteed. Normal processing takes 1-3 business days. For disputes, document everything with screenshots and transaction receipts.

Regulations & Governance (Staying Current)

Bank Indonesia governs QRIS through the Board of Governors Regulations establishing mandatory participation for all QR payment providers. This ensures universal compatibility across existing payment systems infrastructure.

The central bank issues updates through official circulars and regulatory amendments. Major changes typically include industry consultation periods, while operational updates may be implemented with shorter notice periods.

Stay informed by monitoring Bank Indonesia’s official QRIS information resources and press releases. Significant changes affect transaction limits, security requirements, or QRIS cross border capabilities that impact international stakeholders.

Indonesia QRIS: Pros and Cons

Like any payment system, QRIS has advantages and disadvantages for different users. Understanding these helps you make informed decisions about when and how to use QRIS payments.

For Consumers

Pros:

- Universal acceptance at millions of merchants nationwide

- Lightning-fast transactions that complete in seconds

- No need to carry cash or worry about exact change

- Works with your existing banking app or digital wallet

- Growing cross-border acceptance for international travel

- Transaction history automatically recorded for budgeting

Cons:

- Requires internet connection and charged mobile phone battery

- Refund timing varies by merchant and payment provider policies

- Risk of QR code tampering if you’re not vigilant about merchant verification

- Limited recourse if you accidentally pay the wrong merchant

For Merchants

Pros:

- Simple setup process with minimal technical requirements

- Lower and more predictable fees compared to credit card terminals

- Faster checkout process reduces customer waiting times

- Automatic digital transaction records improve accounting

- Access to promotional ecosystems from major payment providers

- Ability to serve customers regardless of their preferred payment app

Cons:

- MDR fees still represent ongoing operational costs

- Requires disciplined reconciliation practices to match payments with sales

- May need POS system updates or process changes for dynamic QR integration

- Business operations become dependent on network connectivity and system uptime

- Staff training needed to help customers with scanning issues

For the Financial Ecosystem and Regulators

Pros:

- Dramatically improves financial inclusion by bringing cash-based businesses into the formal economy

- Enhanced transaction traceability supports better economic data collection and tax compliance

- Increased competition among payment service providers benefits consumers and merchants

- Rich transaction data enables more informed monetary and economic policy decisions

- Reduced reliance on physical cash infrastructure lowers system-wide costs

Cons:

- Ongoing need for consumer education about fraud prevention and safe usage practices

- Regular updates to technical standards require coordination across many industry participants

- Ensuring fair access and preventing anti-competitive behavior requires active regulatory oversight

- System-wide outages, while rare, can disrupt commerce across the entire country

Understanding these trade-offs helps consumers, merchants, and policymakers make informed decisions about QRIS adoption and usage strategies.

FAQs (Clear, Actionable Answers)

Does QRIS work with my payment applications?

If your digital wallets or banking app can scan QR codes for payments, it supports QRIS. All major Indonesian payment providers participate in the system.

Who pays fees for QRIS transactions?

QRIS merchants pay processing fees to their payment service providers, typically up to 0.7% of transaction value. Consumers pay nothing extra for using QRIS payments.

Can foreign visitors use QRIS in Indonesia?

Yes, either through QRIS cross-border partnerships (if available from their countries) or by setting up local Indonesian digital wallets with basic identity verification.

How do refunds work for QRIS payments?

Refunds are processed through the merchant’s payment service providers. Contact QRIS merchants first, then their acquirer if needed. Keep receipts and screenshots for dispute resolution.

Is QRIS secure for cashless payments?

Yes, it uses bank-grade encryption following international standards. Always verify merchant names and avoid scanning suspicious QR codes from photos or unverified sources.

What are transaction value limits for QRIS?

Limits depend on your specific payment providers, typically ranging from Rp2-20 million daily for personal accounts. Business accounts often have higher limits for medium-sized enterprises.

How does QRIS support financial inclusion?

The system enables street vendors and small businesses to accept digital payments without expensive equipment. It also allows people without traditional bank accounts to participate in the digital economy through accessible digital wallets.

What makes QRIS a success story for Indonesia?

QRIS unified fragmented payment systems into one national standard, reduced costs for small businesses, improved financial inclusion, and positioned Indonesia as a leader in digital payment innovation across Southeast Asia.

Ready to Apply or Extend Your Visa?

Let our visa specialists handle your application.