How to Do Indonesia’s e-Custom Declaration Online 2025

If you’re traveling to Indonesia, one essential step before arrival is completing the Electronic Customs Declaration (e-CD). This online form replaces the old paper-based system, making the customs process faster and more efficient.

This guide will help you navigate the e-CD process, ensuring a smooth arrival by covering when and how to submit the form, what needs to be declared, and how to avoid unnecessary delays.

⚠️ What’s New in Indonesia’s Customs Declaration (Sept 2025 Update)

Indonesia has moved from the old standalone Customs e-CD to a single digital arrival card called “All Indonesia.” Instead of filling separate forms (customs, health, immigration, quarantine), you now complete one free form and get one QR code to show on arrival.

When did this start? The rollout began September 1, 2025, at the main gateways: Bali (DPS), Jakarta (CGK), Surabaya (SUB), and key Batam seaports. It becomes mandatory at all international airports across Indonesia on October 1, 2025. Some ports may still use the official e-CD as a fallback during the changeover. What else is different? The timing window is now clearly set to within 72 hours before arrival (submit online, receive a QR, and keep it ready).

What Is the e-Customs Declaration?

The Electronic Customs Declaration (e-CD) is a required online form for all travelers entering Indonesia. It helps customs officials track incoming goods, enforce regulations, and speed up the baggage screening process.

Travelers must use the e-CD to declare personal goods, including items purchased abroad and will remain in Indonesia. Each traveler is allowed an import duty exemption of up to USD 500 per arrival. Any items exceeding this exemption may be subject to duties, excise, and taxes.

Filling Out the Customs Declaration Form Online

Let’s dive into a simplified guide on how to fill out the ECD form for your trip to Indonesia, ensuring all the steps are clear and easy to follow:

Access The Electronic Customs Declaration Form

The first thing you have to do is go to https://ecd.beacukai.go.id/ . You may notice that the language is not in English, but you can change it on the right top of the website. There are 9 languages you can choose: English, Indonesian, French, Arabic, Korean, Spanish, Japanese, Chinese, and Russian.

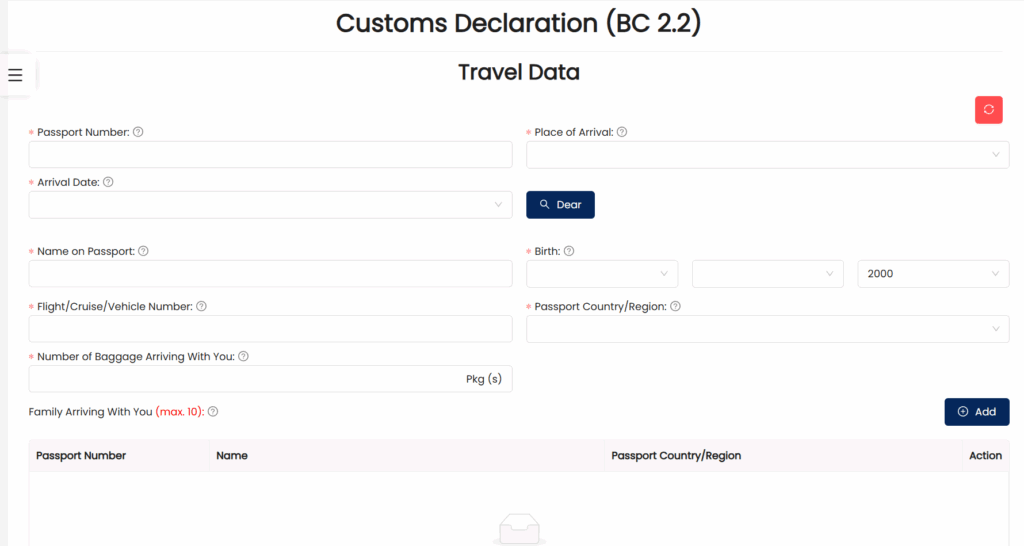

Filling Out Your Details

The customs form’s first page is all about your trip details. You’ll fill out where you’re coming from, your end stop, and how long you’re planning to stay.

- Passport Number

- Place of Arrival

- Arrival Date

- Name on Passport

- Date of Birth (Day, Month, Year)

- Passport Country/Region

- Flight/Cruise/Vehicle Number

- Number of Baggage Arriving With You

- Family Arriving With You (up to 10 people)

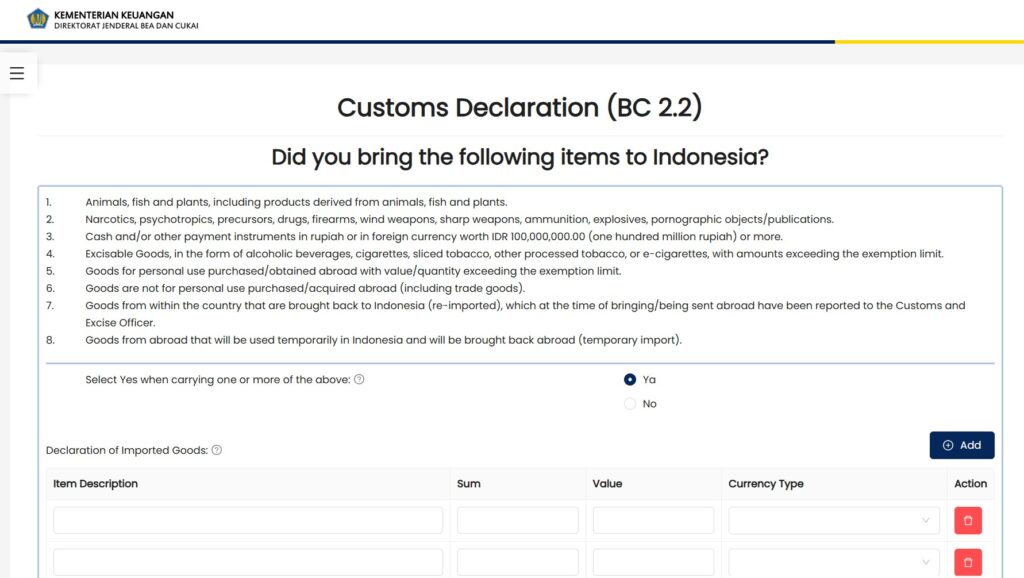

Declare Goods & Currency

- List any items purchased abroad that will remain in Indonesia.

- Declare currency above the Rp. 100,000,000 (or foreign equivalents) threshold.

- Confirm any restricted or prohibited items you may carry.

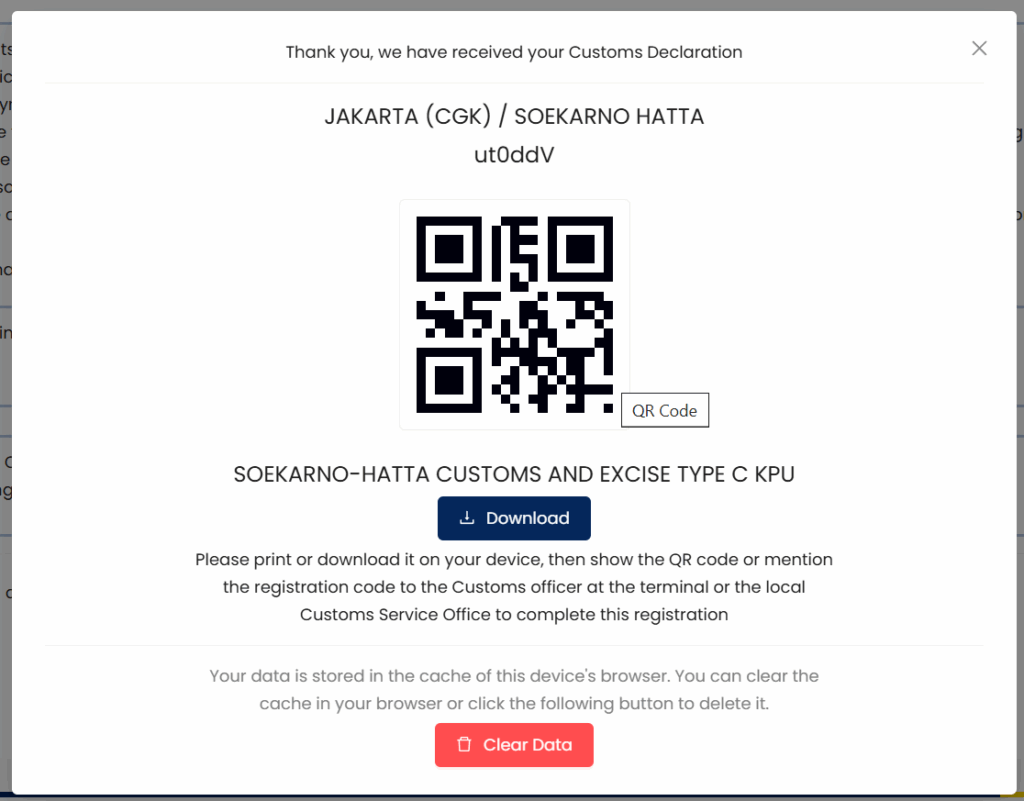

Submit & Obtain the QR Code

- Review all information for accuracy.

- Submit the form and save the QR code you receive (print or screenshot).

- This QR code will be scanned by customs officers upon arrival.

Notifying customs officers about the goods you are carrying can expedite customs services, ensuring compliance with regulations and avoiding penalties for false declarations.

Using Airport Facilities

- If you do not fill the e-CD beforehand, you can do so upon arrival using free Wi-Fi, airport kiosks, or provided computers near the baggage claim.

If you’re traveling with family, you’ll also indicate the number of family members with you.

You’ll need to input details for any relatives accompanying you, as well as complete the customs declaration. For instance, if you’re traveling just with your spouse, you would record ‘1’ under family members and provide their name, passport number, and their relation to you.

A handy tip: one form per family is all you need, making it less of a hassle for group travelers.

What I Should Declare on Electronic Customs Declaration

- Duty-Free Stuff: When you fly in, you are granted import duties worth up to $500 without having to pay any extra charges. If you’re working on the plane, you only get a $50 limit. If you go over these limits, you might have to pay some extra fees.

- Tobacco products and alcohol: If you’re an adult, you’re allowed to bring in 200 cigarettes, 25 cigars, or 100 grams of sliced tobacco. And if you’re over 21, you can also bring a liter of alcohol. People working on the plane can bring less, and if you bring too much, they’ll just throw it away.

- Big Money: If you’re carrying a lot of cash or checks worth more than 100 million Rupiah, equivalent to 6,400 USD, 5,830 EUR, 9,629 AUD,and 4,991 GBP, you need to tell the customs authorities.

- Medicines: If you need to bring medicine that’s usually not allowed in Indonesia, make sure it’s in its original package, declare it when you arrive, and bring the prescription and a doctor’s note explaining why you need it.

- Temporary Import Permit: This permit is for goods not for personal use and it’s valid for up to three years. It requires detailed documentation and might involve a security deposit or import duties based on the type and duration of the goods’ stay in Indonesia

- Personal Items of High Value: Items like jewelry, electronics, and luxury goods that exceed a certain value should be declared. Not declaring these items could lead to suspicions of smuggling or result in taxes and duties upon your departure if they’re believed to have been acquired in Indonesia.

- Cultural Artifacts and Historical Items: If you’re carrying items that could be considered cultural artifacts or historical items, especially from other countries, you need to declare them. Indonesia is sensitive to the import and export of such items to prevent the illegal trade of cultural heritage.

- Commercial Goods: If you’re bringing in goods for commercial purposes, they must be declared regardless of their value. This is crucial as commercial goods are subject to different tax rates and regulations compared to personal belongings. Failure to declare them could result in fines or confiscation of the goods.

- False Declaration: A false declaration constitutes a significant offense and is punishable under relevant laws and regulations. This is especially important in the context of customs regulations related to the importation of goods into Indonesia.

Importing Goods to Indonesia

Some items cannot be brought into Indonesia under any circumstances. If you pack any of these import goods, they could be confiscated, and you might face fines or legal consequences.

- Animals, Fish, and plants, including their products, are subject to import restrictions.

- Narcotics, psychotropic substances, precursors, drugs, firearms, air guns, sharp objects, ammunitions, explosives, and pornography objects are strictly prohibited.

- Currency and/or bearer negotiable instrument in Rupiah or other currencies equal to the amount of 100 million Rupiah or more must be declared.

- Foreign banknotes equivalent to at least Rp. 1,000,000,000.00 (one billion rupiah) must be declared.

Customs Declaration Indonesia Process on Arrival

When you land in Indonesia, having your e-Custom Declaration (e-CD) ready makes everything easier. Here’s what to expect when you go through customs.

1. Scan Your QR Code

After you submit the e-CD, you’ll get a QR code. Keep it on your phone or print it out. When you reach customs, an officer will scan it to check your declaration. This replaces the old paper form, so you don’t have to worry about filling one out at the airport.

2. Customs Inspection

Once your QR code is scanned, you’ll be directed to one of two lanes:

- Green Lane if you don’t have anything to declare. You can just walk through without stopping.

- Red Lane if you have dutiable goods, restricted items, or large amounts of cash. A customs officer will check your declaration and may inspect your bags.

3. Paying Duties and Taxes

If you’re bringing in items worth more than $500, you may need to pay import duties and taxes. Customs officers will assess the amount, and you can pay with cash, credit card, or digital payment at the airport.

4. Be Honest on Your Declaration

It’s important to declare everything correctly. If customs officers find undeclared items in your bags, you could face fines or even confiscation. Indonesia takes customs regulations seriously, so it’s better to be upfront about what you’re bringing.

5. Final Check and Exit

Once customs clears you, you’re good to go. If you need help, there are customs officers available to answer questions.

Important Tips and Reminders

- Be aware of fraudulent sites that may try to charge for this free service or collect personal data.

- Only 37% of travelers have taken advantage of the e-CD system, leading to congestion in arrival areas.

- Filling out the e-CD early can reduce waiting times at the airport.

- Make sure to have the correct visa before entering Indonesia, and apply for a tourist visa in advance if staying longer than 30 days.

Common Questions and Concerns

What happens if I forget to fill out the form?

You’ll have to fill it out before leaving the airport, and free Wi-Fi services and designated computers are available near the baggage claim area.

Do I need to register the IMEI of my phone or tablet?

If you’re staying in Indonesia for less than 90 days, you don’t need to register the IMEI.

Can I bring alcoholic beverages into Indonesia?

Yes, but there are limits and restrictions on the amount and type of alcoholic beverages you can bring.

Kesimpulan

The e-Custom Declaration Form is an essential document for all travelers entering Indonesia. By filling out the form online and understanding the customs declaration process, you can ensure a smooth and hassle-free experience at the airport. Always declare items honestly and ensure you comply with all regulations to avoid any issues or penalties.

Ready to Apply or Extend Your Visa?

Let our visa specialists handle your application.