Hvorfor vi ikke lenger tilbyr PayPal som betalingsalternativ

At visa-indonesia.com, our priority has always been to provide a reliable, transparent, and stress-free visa service for travelers coming to Indonesia.

That includes not only the visa process itself, but also the way payments are handled.

After long consideration and repeated operational challenges, we have decided to discontinue PayPal as a payment method on our website.

Below, we would like to explain this decision openly and respectfully.

Ongoing Operational Challenges

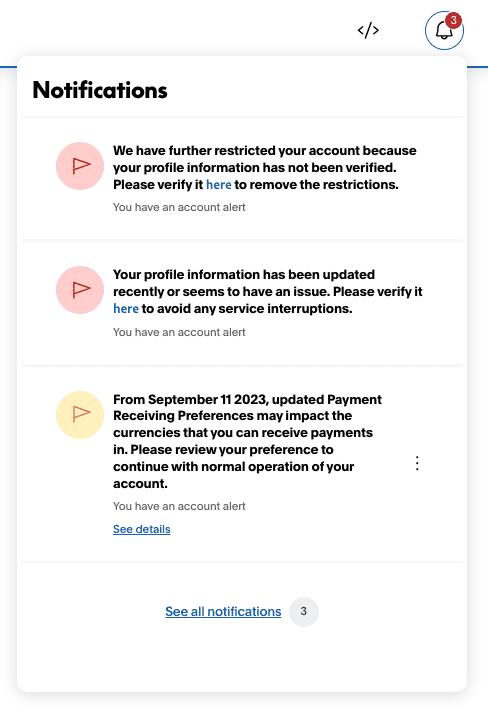

Over an extended period, we experienced recurring difficulties with PayPal that made it increasingly hard to operate smoothly.

Despite always cooperating fully and submitting all requested documentation, PayPal repeatedly requested the same documents multiple times, temporarily limited or froze our account, restricted our ability to receive payments, and prevented us from issuing refunds during internal reviews.

Our company structure is fully legal and transparent, and all requested information was always provided.

Nevertheless, these interruptions continued to occur and directly affected our ability to serve clients without delays.

Requests That Are Difficult to Fulfill

Some of PayPal’s compliance requirements were particularly challenging in an Indonesian business environment.

For example, we were repeatedly asked to provide a traditional electricity bill for our Bali office, despite explaining several times that the property uses a prepaid electricity system, which is very common across Indonesia and does not generate monthly bills.

Even after clarification, the same request continued.

In another case, PayPal asked us to disclose detailed client information, which we cannot do due to data protection, privacy obligations, and ethical business standards.

A Real Case That Raised Serious Concerns

One particular dispute highlighted a deeper structural problem.

A client ordered a Visa on Arrival service through our platform.

The visa was successfully issued.

The client entered Indonesia without any issues.

The stay in Bali was completed normally.

The client returned to their home country.

After returning home, the client unexpectedly requested a full refund through PayPal, despite having fully used the service and previously expressing satisfaction.

We immediately attempted to contact the client via WhatsApp and email, but received no response at all.

We provided PayPal with complete documentation, including proof of service delivery and evidence that the visa had been successfully used.

Despite this, PayPal decided the case in favor of the client and processed a full refund.

This situation was particularly concerning, as it placed the entire financial risk solely on the service provider, even when the service had clearly been delivered and consumed.

Financial Reality of PayPal Transactions

In addition to operational challenges, PayPal transactions also involve significantly higher real costs.

Due to multi-currency payments, funds are automatically converted into Indonesian Rupiah using exchange rates that are often far below market value.

In practice, this results in total costs of approximately 8–10% per transaction.

We absorbed a large part of these costs ourselves and only passed about 5% to our clients, even though the real expense was considerably higher.

Other modern payment providers offer far more transparent and predictable pricing models.

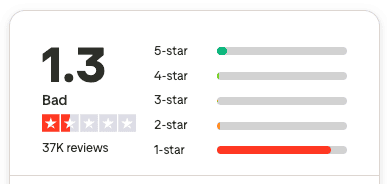

Broader Market Feedback

Our experience is not unique.

Public feedback across the internet reflects similar frustrations from businesses and consumers worldwide.

More than a thousand people search monthly for terms expressing dissatisfaction with PayPal.

Independent websites exist documenting user experiences.

Trustpilot currently shows an average rating of 1.3 stars for PayPal as of January 2026 with around 37,000 reviews.

A visual illustration of this data will be added here shortly.

Why We Believe There Are Better Alternatives Today

The payment landscape has evolved significantly.

Today, clients and businesses have access to reliable card payment processors, secure international bank transfers, modern fintech platforms, and digital asset payment options.

These solutions provide greater stability, better dispute handling, lower processing costs, and fewer account interruptions.

Our Current Payment Options

To ensure reliability for both our clients and our operations, we now offer credit and debit card payments, bank transfers, and cryptocurrency payments.

This allows greater flexibility while minimizing delays, freezes, and payment-related uncertainty.

Our Commitment to Fairness and Transparency

This decision was not made against PayPal as a brand, but in favor of stability, fairness, and service continuity.

Our responsibility is to protect our clients, their visa applications, their timelines, and their payments.

By moving away from PayPal, we can ensure smoother processing and a more predictable experience for everyone involved.

If you have any questions regarding available payment methods, our support team is always happy to assist.

Thank you for your trust in visa-indonesia.com.

Klar til å søke eller forlenge visumet ditt?

La visumspesialistene våre håndtere søknaden din.