PT PMA проти PT PMDN Тип компанії в Індонезії

If you’re a foreigner living in Indonesia and planning to start a business, you’ve probably heard the term PT PMA over and over. Maybe you’ve also seen PT PMDN mentioned in laws, blogs, or by your notary and wondered, “Do I need that too?”

Short answer: PT PMA is the structure designed for foreign investment. PT PMDN is for domestic investment by Indonesians. It’s not a company type you, as a foreigner, can use for your own shares – but it still matters, because it shapes the rules around sectors, capital, and possible local partners.

The tricky part is that most explanations are written for lawyers, not for people who just want to run a legit business and sleep well at night.

This guide breaks down PT PMA vs PT PMDN in plain English. You’ll see what each one actually means, where foreigners fit in (and where they don’t), how capital and sector rules work today, and how to choose a setup that keeps you compliant while you build your life and business in Indonesia.

Why Your Company Type (PMA vs PMDN) Matters

Choosing between PT PMA and PT PMDN is not merely a small administrative detail. It shapes:

- Who can own your company?

- Which business sectors are you allowed to enter?

- How much capital are you expected to invest?

- Whether you can sponsor foreign staff or investor KITAS.

- How heavy is your reporting and compliance workload?

For example, a foreign founder who wants to run a service business in the Indonesian market cannot just “borrow” a local PT and pretend everything is fine. Foreign investment in Indonesia has its own rules under Law No. 25 of 2007 on Investment and newer regulations that sit on top of it.

On the other hand, a small Indonesian-owned bakery doesn’t need a foreign investment company with a high minimum capital requirement. For them, a domestic setup can be faster, cheaper, and more flexible.

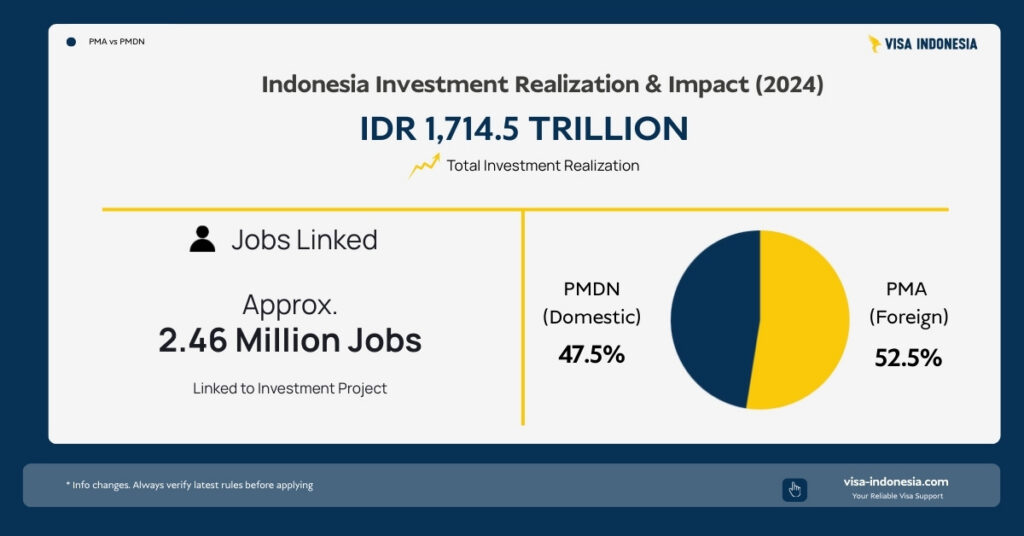

The impact of this decision is massive: Indonesia recently recorded IDR 1,714.2T in investment realisation, creating 2,456,130 jobs, with Foreign Direct Investment (PMA) making up 52.5% and Domestic Investment (PMDN) making up 47.5%.

This roughly 50/50 split between PMA and PMDN investment underscores the strategic importance of both capital sources to the national economy. To grasp what this means for your business setup, let’s begin with a rapid comparison of the fundamentals.

PT PMA vs PT PMDN at a Glance

| Особливість | PT PMA (Foreign Investment) | PT PMDN (Domestic Investment) |

| Ownership | Up to 100% foreign ownership possible (subject to caps). | Must be 100% owned by Indonesian investors. |

| Capital | Expected to be large-scale (typically > IDR 10B total investment). | Can be any scale (Micro, Small, Medium, or Large). |

| Sector Access | Restricted by the Positive Investment List (DPI). | Accesses sectors restricted to domestic investors/MSMEs. |

| Oversight | Higher scrutiny as FDI; strict LKPM reporting expected. | Simpler procedures and less reporting for MSMEs. |

| Foreign Staff | Standard vehicle for foreign directors/specialists. | Possible, but subject to higher scrutiny on rationale. |

Let’s get a quick picture first.

PT PMA означає Perseroan Terbatas Penanaman Modal Asing – a limited liability company that has іноземні інвестиції in it. Under Indonesian investment law, foreign investment means money coming from foreign individuals, foreign companies, or foreign governments to do business in Indonesia.

PT PMDN означає Perseroan Terbatas Penanaman Modal Dalam Negeri – a limited liability company where the investment comes from domestic investors only (Indonesian citizens, Indonesian legal entities, or the state/regions).

In simple terms, the government doesn’t look first at who sits in the director’s chair. It looks at who owns the shares. If any of the shareholders are foreign, the company is treated as foreign investment and falls into the PT PMA bucket. If every shareholder is Indonesian, it’s treated as PT PMDN, a domestic-investment company.

The Legal Backbone: Where These Rules Come From

Indonesian investment, regulated primarily by Law No. 25 of 2007 on Investment, distinguishes between Domestic Investment (PMDN), using domestic capital and investors, and Foreign Investment (PMA), involving foreign capital and investors. PMA must generally be a limited liability company (PT) established in Indonesia.

Other key regulations include the Company Law and rules from the Investment Coordinating Board (BKPM)/Ministry of Investment regarding capital and licensing. The Ministry of Law and Human Rights also legalizes company incorporation.

How Company Establishment Works (For Both PMA and PMDN)

The basic company incorporation path is similar whether you’re forming a PT PMA or a PT PMDN. Think of it as a single, extended registration process with a few additional checks for foreign entities.

In simple terms, the flow looks like this:

- Define what you’ll actually do.

You choose your KBLI codes (Indonesia’s business classification system). This tells the government what business activities you plan to do. - Work with a notary to draft the deed.

You create an Akta Pendirian PT (deed of establishment) in Indonesian. It states your company name, purpose, capital, shareholders, and management structure. - Get approval from the Ministry of Law and Human Rights.

Once they obtain approval and issue the decree, your PT becomes a legal entity under Indonesian law. - Register through the OSS system.

In the Online Single Submission OSS platform, you register the company, get your Business Identification Number, and obtain risk-based business licensing depending on your business sectors and risk level. - Handle tax registration.

You obtain a tax number, register with the tax office, and, if needed, register as a VAT-registered company so you can pay taxes properly. - Open a company bank account and inject capital.

For PMA, this step is watched more closely because the minimum paid-up capital and total investment value matter. For PMDN, capital follows domestic scales like micro, small, medium, or large. - Apply for extra sectoral permits if needed.

Certain business fields (like construction, healthcare, or tourism) have their own extra licenses on top of what the OSS system gives you.

The process is the same for both PT PMA and PT PMDN in structure, but the minimum capital requirement, checks, and supervision are much tighter on the foreign-owned company side.

What Is PT PMA? (Foreign Investment Company)

Now let’s zoom in on the foreign side.

Who PT PMA Is For

A PT PMA is for situations where foreign investors own shares in the company. That can mean:

- One foreign national owns 100%.

- A foreign company and an Indonesian local investor own shares together.

- Several foreign shareholders and domestic shareholders are in one cap table.

Under the investment law, foreign investors can be individuals, foreign legal entities, or foreign governments.

Even if the foreign share is small, once foreign shareholders are on the cap table at the company level, the company is treated as a foreign direct investment vehicle.

Minimum Investment and Capital for PT PMA

This is the part everyone asks about first: how much money are we talking about?

Right now, you need to separate two ideas:

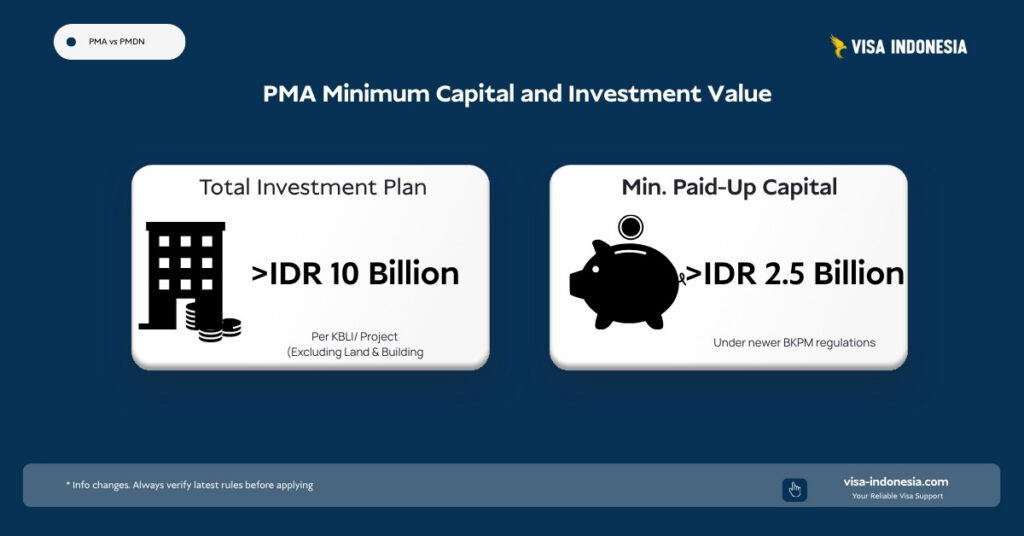

- Minimum total investment value

The Positive Investment List and related rules say foreign investment can only do business as a large enterprise, with total investment per business line generally above IDR 10 billion, excluding land and buildings. - Мінімальний сплачений капітал

Older guides talked about IDR 10 billion as paid-up capital. That has changed. Recent regulations have lowered the minimum paid-up capital for a standard PT PMA to around IDR 2.5 billion, unless a specific sector rule sets a higher capital requirement.

So a typical setup today for a PMA foreign investment company looks like:

- Investment plan: say, IDR 11 billion total (business plan level).

- Paid-up capital: at least IDR 2.5 billion actually injected and recorded.

The government still expects your інвестиційний план to fit the “large enterprise” band, while giving more flexibility on how much money you put in at the start.

Sector Access for PT PMA

Can a PT PMA do anything? No.

It must follow the Список позитивних інвестицій, which divides business sectors into:

- Open to 100% foreign ownership. Some activities allow full foreign ownership.

- Open but capped. Some sectors allow foreign ownership but up to a certain percentage, sometimes with special rules for ASEAN and Southeast Asia investors.

- Closed or reserved. Some activities are reserved for cooperatives and MSMEs or are not open to foreign investors at all.

That means before you even think about share percentages, you must:

- Confirm that your KBLI is open to foreign ownership.

- Check if there is a maximum foreign-ownership cap.

- Decide whether you need a local investor to fill the remaining shares.

Advantages of PT PMA

PT PMA gives foreign entities a clean, legal way to own and control a company in Indonesia.

Some core advantages:

- Ти можеш operate legally and earn revenue in Indonesia instead of using risky side arrangements.

- You can sponsor foreign workers and investor visa permits through the PT PMA structure.

- You can structure cross-border payments (dividends, management fees, royalties) while staying within tax rules and investment facilities.

For serious international investors, PT PMA is almost always the real starting point for business in Indonesia.

Limitations of PT PMA

Of course, PT PMA is not for everyone.

Some key downsides:

- Higher мінімальний капітал expectations and more detailed supervision.

- Certain business activities are fully or partly closed to foreign ownership.

- Heavier reporting and stricter regulatory compliance compared to a small local PT.

If you only have a tiny budget and no plan to scale, PT PMA might be more structured than you actually need at this stage.

What Is PT PMDN? (Domestic Investment Company)

Now let’s look at the domestic side.

Who PT PMDN Is For

A PT PMDN is a PT where all investors are domestic. Under the investment law, that means:

- Indonesian citizens.

- Indonesian legal entities.

- The central government or regional governments.

The capital used is domestic capital. If, at some point, you bring in a foreign shareholder at the company level, you’re moving into PMA territory and may have to convert your status to Penanaman Modal Asing (PMA).

Capital and Scale: Micro, Small, Medium, Large

For a domestic investment company, there is no single national “10 billion” rule like for foreign investment. PMDN capital is often described by scale: < Rp 1B (micro), Rp 1–5B (small), Rp 5–10B (medium), > Rp 10B (large).

This allows domestic businesses to start smaller and grow step by step, rather than having to jump straight to large-enterprise size on day one.

Sector Access and Domestic Priority

PT PMDN has access to:

- Sectors that are completely open to both foreign and domestic investment.

- Sectors that are reserved for domestic investors or MSMEs, where foreign investors are either banned or heavily limited.

This is part of how the Indonesian government protects and promotes local market players. By reserving certain activities for domestic entrepreneurs, they make sure foreign capital doesn’t crowd out local SMEs in sensitive or strategic areas.

Advantages of PT PMDN

Some reasons Indonesian founders stick with PT PMDN:

- Lower capital expectation, especially for smaller businesses just starting to conduct business.

- Broader sector access in areas that are off-limits or capped for foreign investors.

- Simpler cross-border issues, since ownership and most transactions are local.

For small cafés, local PT distributors, or family-owned services, PT PMDN usually makes more sense than forcing a foreign investment structure.

Limitations of PT PMDN

The trade-offs:

- You cannot legally include foreign shareholders in a PT PMDN.

- It can be harder to raise capital from international investors later if they want direct equity.

- For employing foreign workers, you may face more hurdles than a PT PMA that is clearly built as a foreign investment company.

Compliance and Reporting: Taxes, LKPM, and Corporate Hygiene

No matter which route you choose, one thing is the same: Indonesia cares about reporting.

LKPM – Investment Activity Reports

The Investment Activity Report (LKPM) is a periodic report that investment companies submit to the Investment Coordinating Board. This submission is due on the 15th of the reporting months (Apr/Jul/Oct/Jan). It shows:

- How much investment has actually been realized compared to your investment plan?

- How many workers do you employ?

- What your production or operations look like.

- Any problems blocking your progress?

LKPM is regulated by BKPM rules and must be submitted online through the OSS system.

Recent guidance explains:

- Small businesses with investments under a certain value report every six months.

- Medium and large businesses must report every quarter.

In practice, PT PMA and medium/large PT PMDN are closely watched on LKPM. Missed or sloppy reports can cause warnings, flagged licenses, or, in serious cases, problems with future approvals.

If you prefer not to deal with the bureaucracy, the Visa-Indonesia team can help you with a comprehensive LKPM reporting service to keep you compliant.

Tax Obligations

Both PT PMA and PT PMDN pay corporate income tax and must pay taxes in line with Indonesian tax law.

PT PMA often deals with more cross-border payments: dividends going abroad, management fees to a parent company, royalties for intellectual property, and so on. This triggers withholding tax, possible double-tax treaty questions, and more attention from the tax office.

So while the tax law is the same, the complexity is often higher for foreign investment companies.

Manpower and Immigration

If you hire foreign workers, you enter a separate rulebook:

- You may need an approved manpower plan and work permits.

- Each foreign national will need the right stay permit, which many people call an investor visa або work KITAS.

PT PMA is usually the structure that authorities expect to see when a company employs foreign staff long-term. PT PMDN can sometimes sponsor foreigners, too, but it tends to be more limited and more closely inspected.

Corporate Housekeeping

For both PMA and PMDN, you also have standard PT obligations:

- Hold annual shareholder meetings.

- Prepare proper financial statements.

- Report key changes (directors, commissioners, shareholders, address) through a notary and update OSS.

Ignoring these “boring” duties is a good way to run into trouble later when you need financing, due diligence, or want to sell part of the company.

Converting PT PMDN into PT PMA

Sometimes you don’t start with PMA. You start domestic, then foreign investors arrive.

When Conversion Makes Sense or Becomes Necessary

Conversion from PT PMDN to PT PMA becomes relevant when:

- A foreign investor wants to buy shares in your existing PT.

- A foreign parent wants to acquire the local company.

- You want to restructure ownership so foreign partners are visible at the company level, not just behind contracts.

Once foreign shareholders come in, the company will be treated as a foreign investment. At that point, it should comply with PMA rules: sector openness, minimum capital, reporting, and licensing.

What Conversion Usually Involves

At a high level, conversion looks like this:

- Shareholder decision. The existing shareholders agree to invite foreign investors and approve changes to the capital structure and the company’s articles.

- Notarial changes. A notary drafts deeds to reflect new shareholders, new capital amounts, and any other structural changes.

- Regulatory updates. You update company data with the Ministry of Law and Human Rights, adjust your profile in OSS, and align your NIB and licenses with PMA status.

- Capital and sector checks. You make sure your investment plan and paid-up capital now meet PMA thresholds and that your KBLI is allowed for foreign ownership.

If that sounds like a lot, that’s because it is. But doing it properly once is much cheaper than trying to undo a messy structure later.

Pitfalls to Avoid

Some common traps during conversion:

- Capital still looks too small for PT PMA foreign investment. Remember, foreign investment is supposed to be large enterprise-level.

- The sector is not actually open to foreign investors or outside priority business fields.

- Reporting is not aligned. If your LKPM records and your new capital structure don’t tell the same story, expect questions.

Setting Up a PT PMDN With a Nominee

Some foreigners are told, “Just use a local PT PMDN in your friend’s name. You’ll be the real owner behind the scenes.” That setup is usually called a nominee structure.

On paper, the company looks like a normal PT PMDN:

All the shareholders are Indonesian, so it’s treated as domestic investment.

In practice, the foreigner puts in the money, makes the decisions, and there’s a side agreement saying the local “owner” is only lending their name.

It can feel like an easy fix, but it comes with real risks:

- Weak protection for the foreigner

Your rights often sit in private contracts that may be hard to enforce.

If the nominee refuses to cooperate, you can lose control of “your” company. - Regulatory risk

Investment law expects foreign capital to go through PT PMA, not be hidden inside PT PMDN.

If authorities see it as a way to dodge foreign-ownership rules, you may face serious questions later. - Problems with banks and investors

When you apply for loans or bring in serious investors, they will check who really owns the company.

A nominee setup can scare them off or force you to restructure before they say yes.

If a foreigner is meant to be the real owner, the safest path is to use a PT PMA (with or without Indonesian partners) or another clear, legal structure like a representative office or a clean contract with an existing local PT.

What if I Want to Create Just a Small Business?

This is the question almost every foreigner asks once they hear about the 10 мільярдів IDR investment requirement:

“But I only want to start a small business. Do I really need that much?”

Let’s untangle that.

First, that 10 мільярдів IDR number is about your total investment plan, not a suitcase of cash you must drop on day one. It’s the value of the business you’re planning to build over time – equipment, fit-out, systems, staff, working capital – not just money sitting in a bank account. The minimum paid-up capital for a typical PT PMA is now around IDR 2.5 billion, which is still serious money, but much lower than the old 10B rule.

If you truly can’t reach that level yet, you have a few realistic options:

- Stay small and work through a local PT PMDN

You can partner with a trusted Indonesian business that owns the company and invoices clients, while you come in as an employee, consultant, or contractor. The key is: you’re не the owner. The local side really is. That keeps it within the domestic-investment box and avoids fake nominee setups. - Use a representative office if you just want a presence

If your main goal is to test the market, do research, or support a head office abroad (and not issue local invoices), a представництво can be enough for a while. It’s not a full commercial company, but it lets you learn the market before you commit big capital. - Wait and build toward a proper PT PMA

Some foreigners start by working remotely for Indonesian clients or building the brand from abroad. Once the business is proven and the capital is there, they upgrade into a PT PMA that matches the foreign-investment rules from day one.

The big takeaway: if you want to власний an Indonesian company as a foreigner, you need to play in the PT PMA space and respect the investment thresholds. If you’re not there yet, it’s better to choose a structure that honestly matches your current size than to force a “small” PT PMA or hide behind a risky nominee PT PMDN.

Поширені запитання

Can a foreigner own shares in a PT PMDN?

Not if it wants to stay a true PT PMDN. By definition, PMDN means domestic investors using domestic capital. If you add foreign shareholders, the company should be treated as a foreign investment and follow PMA rules.

Can a PT PMA be 100% foreign-owned?

Yes, in many sectors it can, as long as the Positive Investment List allows 100% foreign ownership for that KBLI. In other sectors, there may be a cap or a requirement for local partners.

What happens if my planned investment is below IDR 10 billion?

Then you may not fit the typical PT PMA profile, because foreign investment is expected to be large-scale with investment value above that threshold. You might need to rethink your structure, scale up your plan, or explore other setups like partnerships or working through a representative office.

Do both PMA and PMDN have to submit LKPM?

Yes, investment companies in both categories are subject to LKPM if they meet the thresholds. PT PMA is generally always in scope. PT PMDN obligations depend on their investment size and classification.

Which structure is better for my own investor visa?

In most cases, PT PMA is better suited. It supports the story that you are a foreign investor managing your own foreign investment company in Indonesia, which matches the intent of investor-type stay permits.

Готові подати заяву або продовжити візу?

Дозвольте нашим візовим спеціалістам опрацювати вашу заяву.